Avoiding Nice

I have nothing in common with a person who thinks it’s a good idea to hold on to META, for example, through a -70% decline because “it’s still a good company” or “I believe in

I have nothing in common with a person who thinks it’s a good idea to hold on to META, for example, through a -70% decline because “it’s still a good company” or “I believe in

Working at my first job after college in 2007, I recall getting the idea to start a fund. It was mostly a “that would be cool” kind of idea. Very wishy washy and dreamy. My

Fall is here. Crops are ready to be harvested. All of the hard work farmers have done since the spring is about to pay off. Pumpkins, turnips, squash, zucchini, beets, eggplant, celery, apples, cranberries, grapes,

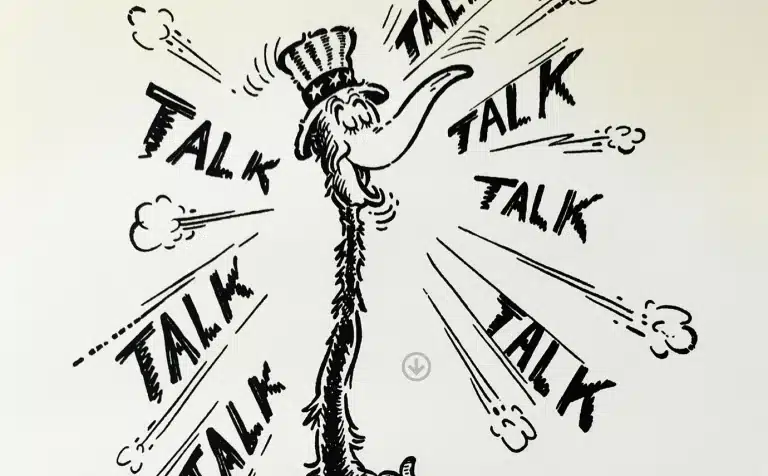

When people get nervous they embrace many unhealthy remedies. They do all they can to avoid feeling nervous. In the markets, a popular remedy is talking. People like to talk and talk and talk. And

Bulls and Bears suffer from the same affliction — pareidolia. That is, seeing something, typically a pattern or image, that isn’t there. Examples of pareidolia: Bulls see the current equities chart pattern as one that

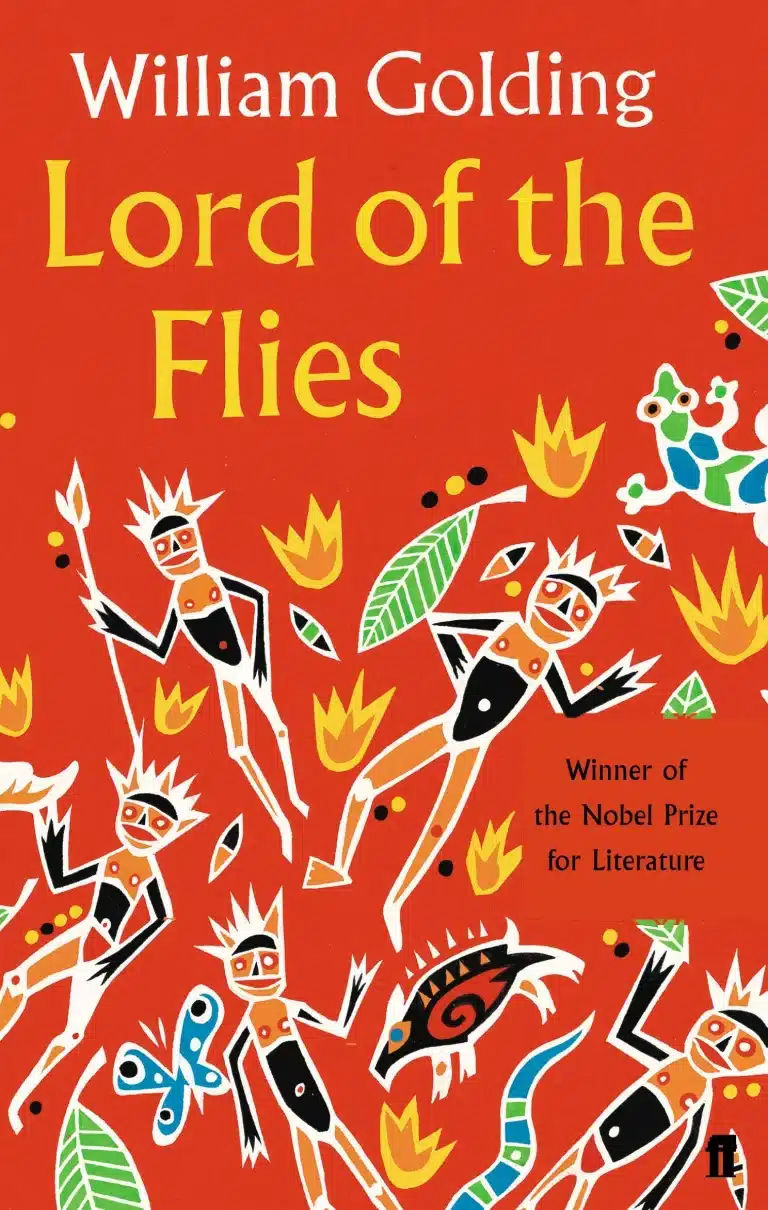

I had never read Lord of the Flies, but recently I’ve been intrigued by the old classics, so I picked it up. Early in the book, as the boys collect their bearings, they agree to

Too much of one thing can ruin the whole thing. A chef must be mindful of the ingredients s/he uses so as to not overpower the dish with any one flavor. A weightlifter mustn’t overtrain

Investing takes patience. And faith. Faith that opportunities will eventually come. From where? We don’t know. When? We don’t know that either. Many people, uncomfortable with eventually, develop and believe in narratives to address this

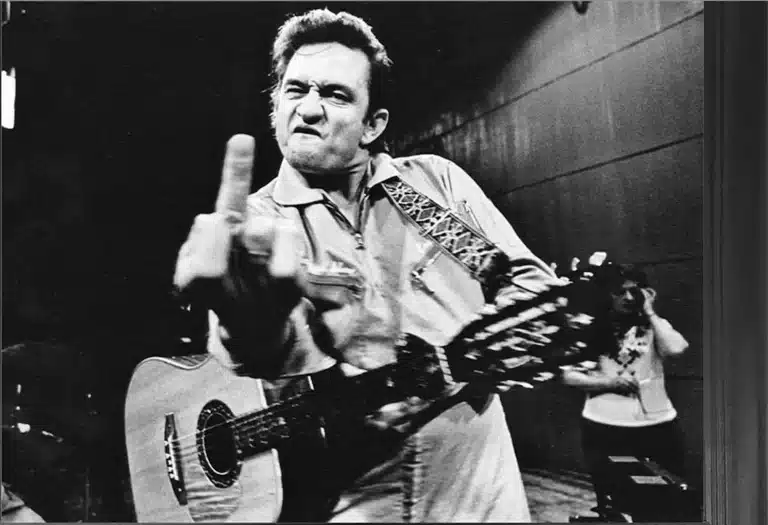

The hardest thing is sticking around. Surviving in the investing business, hell in any business, is a success in and of itself. Navigating the market, employees, customers and most importantly, yourself, is tough. In the

We don’t need an advanced degree to know that markets have gotten more bubbly lately. For those of us who watch the markets regularly, we’ve see an increasing number of parabolic moves over the past

I don’t have performance-standards for my trading. No goals for annualized growth figures or anything like that. That’s a recipe for stress and failure. I simply start with “how much am I willing to lose?”.

Forest fires clear the way for new growth. Storms remove stale air out of a region. Predators cull the weak, which helps control overpopulation. Bear markets purge greedy speculators and those that gather an abundance

Deep down, we all know cycles are natural and something to expect when playing the markets. Stocks, bonds, commodities, currencies, investment strategies — hell, everything in the cosmos — experiences cycles. Some cycles flow calmly

This weekend I was speaking with a young trader and a question about research inevitably came up. “What research are you working on to maintain your edge in the markets?” My answer: Following your system

Most people gather too much sludge in their portfolios. They start out with a few mutual funds and ETFs then, before they know it, a couple dozen stocks make their way in too. Where did

The answer to what the markets will do cannot be found in multiple choice answers A through D. The question to ask is not “what will the markets do over the next 12-24 months?”, but

The information provided on this website is for informational purposes only. By clicking “Accept and Acknowledge” you represent that you are a “qualified eligible person” as that term is defined in CFTC Regulation 4.7 and are a “qualified client” as that term is defined in SEC Rule 205-3(d)(1) under the Investment Advisers Act. Visitors to this website assume all responsibility and risk for the use of this website. If you detect any omissions, misstatements or errors, please contact us immediately. All information appearing on this website may be revised or withdrawn, in whole or in part, at any time without notice and shall not in any event form or constitute part of an offer or terms and conditions of a contract. By using this website, you agree to be bound by any such revisions. The information provided on this website does not constitute an offer to sell or a solicitation of an offer to purchase any securities or investment products, and may not be copied, shown, transmitted or otherwise given to any other person without Melissinos Trading prior written consent. A complete description of the principal risk factors, fees and expenses applicable to an investment in a fund or account managed by Melissinos Trading is provided in the relevant Melissinos Trading disclosure document (use the sodapdf to save these documents as pdf on your computer). Past performance is not necessarily indicative of future results. Futures trading is speculative and involves substantial risk of loss.

Summary Risk Disclosure Statement

THE RISK OF LOSS IN TRADING COMMODITIES CAN BE SUBSTANTIAL. YOU SHOULD THEREFORE CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. THE HIGH DEGREE OF LEVERAGE THAT IS OFTEN OBTAINABLE IN COMMODITY TRADING CAN WORK AGAINST YOU AS WELL AS FOR YOU. THE USE OF LEVERAGE CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS LARGE GAINS. IN SOME CASES, MANAGED COMMODITY ACCOUNTS ARE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT AND ADVISORY FEES. IT MAY BE NECESSARY FOR THOSE ACCOUNTS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THE DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF THE PRINCIPAL RISK FACTORS AND EACH FEE TO BE CHARGED TO YOUR ACCOUNT BY Melissinos Trading (A COMMODITY TRADING ADVISOR, OR “CTA”).

THE REGULATIONS OF THE COMMODITY FUTURES TRADING COMMISSION (CFTC) REQUIRE THAT PROSPECTIVE CLIENTS OF A CTA RECEIVE A DISCLOSURE DOCUMENT WHEN THEY ARE SOLICITED TO ENTER INTO AN AGREEMENT WHEREBY THE CTA WILL DIRECT OR GUIDE THE CLIENT’S COMMODITY INTEREST TRADING AND THAT CERTAIN RISK FACTORS BE HIGHLIGHTED. THIS DOCUMENT IS READILY ACCESSIBLE AT THIS WEBSITE. THIS BRIEF STATEMENT CANNOT DISCLOSE ALL OF THE RISKS AND OTHER SIGNIFICANT ASPECTS OF THE COMMODITY MARKETS. THEREFORE, YOU SHOULD ACCESS THE DISCLOSURE DOCUMENT DIRECTLY AND STUDY IT CAREFULLY TO DETERMINE WHETHER SUCH TRADING IS APPROPRIATE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. YOU ARE ENCOURAGED TO ACCESS THE DISCLOSURE DOCUMENT BY CLICKING ON THE PROMINENTLY PLACED ‘DISCLOSURE DOCUMENT’ BUTTON ON ANY OF THE FOLLOWING PAGES. YOU WILL NOT INCUR ANY ADDITIONAL CHARGES BY ACCESSING THE DISCLOSURE DOCUMENT IN THIS FASHION. YOU MAY ALSO REQUEST DELIVERY OF A HARD COPY OF THE DISCLOSURE DOCUMENT, WHICH ALSO WILL BE PROVIDED TO YOU AT NO COST. THE CFTC HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN ANY OF THE FOLLOWING TRADING PROGRAMS NOR ON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE DOCUMENT OR THIS WEBSITE. OTHER DISCLOSURE STATEMENTS ARE REQUIRED TO BE PROVIDED TO YOU BEFORE A COMMODITY ACCOUNT MAY BE OPENED. PLEASE ACKNOWLEDGE YOUR UNDERSTANDING OF THIS IMPORTANT STATEMENT BY CLICKING THE ‘I ACCEPT’ BUTTON BELOW.

Terms and Conditions

In order to use this site, you must accept the terms and conditions of use (the Terms) of this web site. Click to view the Terms and please review them carefully.

The Terms are accepted by selecting the “I ACCEPT AND ACKNOWLEDGE” button below. Acceptance by any representative of an entity is acceptance by that entity.

By selecting the “I ACCEPT AND ACKNOWLEDGE” button below or by otherwise accessing this site, the investor or representative of an entity investor acknowledges that he or she has read these Terms and the Disclosure Document. The regulations of the CFTC require that prospective clients of a CTA receive a Disclosure Document when they are solicited to enter into an agreement whereby the CTA will direct or guide the client’s commodity interest trading and that certain risk factors be highlighted. This document is readily accessible at this site. You should proceed directly to the Disclosure Document and study it carefully to determine whether such trading is appropriate for you in light of your financial condition. You are encouraged to access the Disclosure Document by clicking below. You may also request delivery of a hard copy of the Disclosure Document, which will be provided to you at no cost. The CFTC has not passed upon the merits of participating in any Melissinos Trading program nor on the adequacy or accuracy of the Disclosure Document or this web site. We reserve the right to amend these Terms at any time. These Terms were last modified on May 31st, 2018.

If you agree with these Terms, please select the “I ACCEPT AND ACKNOWLEDGE” button below. If you review the Disclosure Document, you will still need to accept or decline the Terms before you can gain access to this page.