There’s a prevailing opinion out there that if you don’t get in at the perfect time then the opportunity is gone. Don’t bother with this investment anymore because what’s even the point, right? Better to find another one where the perfect entry still exists.

“I could’ve owned Apple or Google but I missed it.” You missed it? You may have thought you missed it at the time, but there have been plenty of other times you could’ve gotten in. A near endless amount actually.

I think people just get so annoyed at not being perfect themselves that they throw good opportunity away.

“Damnit I missed the entry! I’m an idiot. OK to hell with this one, let’s find another one that can deliver me this feeling I crave.”

There might be plenty of opportunity left in the one they passed over, but making money isn’t good enough. They need to feel smart and show off how smart they are too.

I don’t believe in perfect. I believe in “good enough”.

As a trend-trader, I care about protecting my ass and making money. Hell, part of the design of a trend-based strategy is waiting to buy in after a bottom and selling out after the market topped. Feeling smart as a trend-trader is mostly luck and short-lived. Even when you make money, you’re on edge waiting for the inevitable reversal.

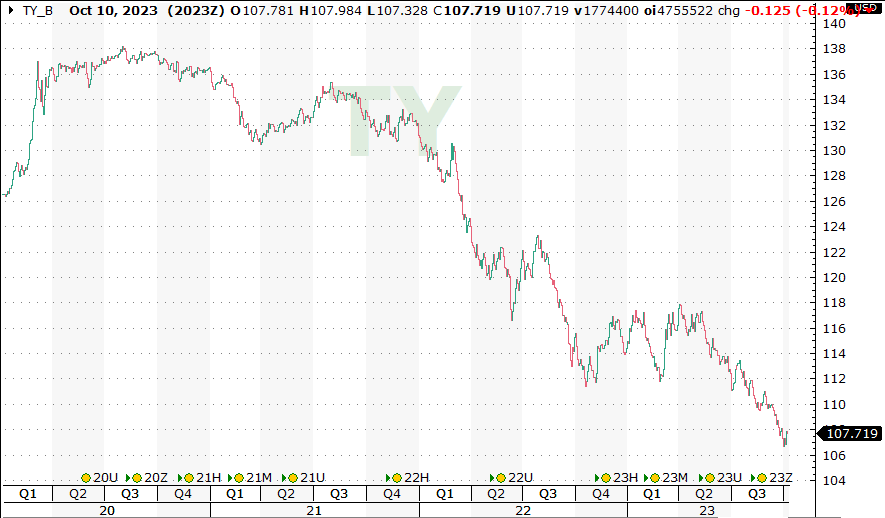

Bond prices have been falling for over two years now. So what that you didn’t get in at the top? You didn’t need to. You’ve had plenty of other opportunities to get in and ride that trend down.

Missing moves, especially ones as good as the one in bonds, is unacceptable. Can’t happen. Put pride aside. Get aboard the ride.

U.S. 10-Year Note Futures

I think it’s a good idea for all of us to reflect on opportunities we’ve passed over. The ones we saw, but didn’t pull the trigger on. What feelings kept us from doing the right thing?

This will help us learn about ourselves and recognize our own biases and patterns. It will also help in giving ourselves a break; realizing that we’re human and that other people behave similarly.