We must not discount the effects recent performance has on our beliefs and behavior. What we know to be true may only have been true…lately. It’s a big world out there with a lot of history. There’s no telling what the future can bring, so holding on to beliefs makes you less adaptive and more prone to risk.

I believe it’s important to look beyond the most recent 5-10 years. Go back as far as you can. And don’t only look at your local markets. Look abroad. Just because events happened there, doesn’t mean they can’t happen here. If there’s one thing I’ve learned studying the markets it’s that anything can happen. The unthinkable happens.

Being flexible. Holding loosely held beliefs. Going with the trends and prioritizing risk management. These are the skills of the most successful investors over time. They’re not religious. They’re adaptive, opportunistic but protective. Being romantic about how you made your money back in the day will put you at serious risk going forward.

Things change. It’s normal. If you choose to believe anything, believe that.

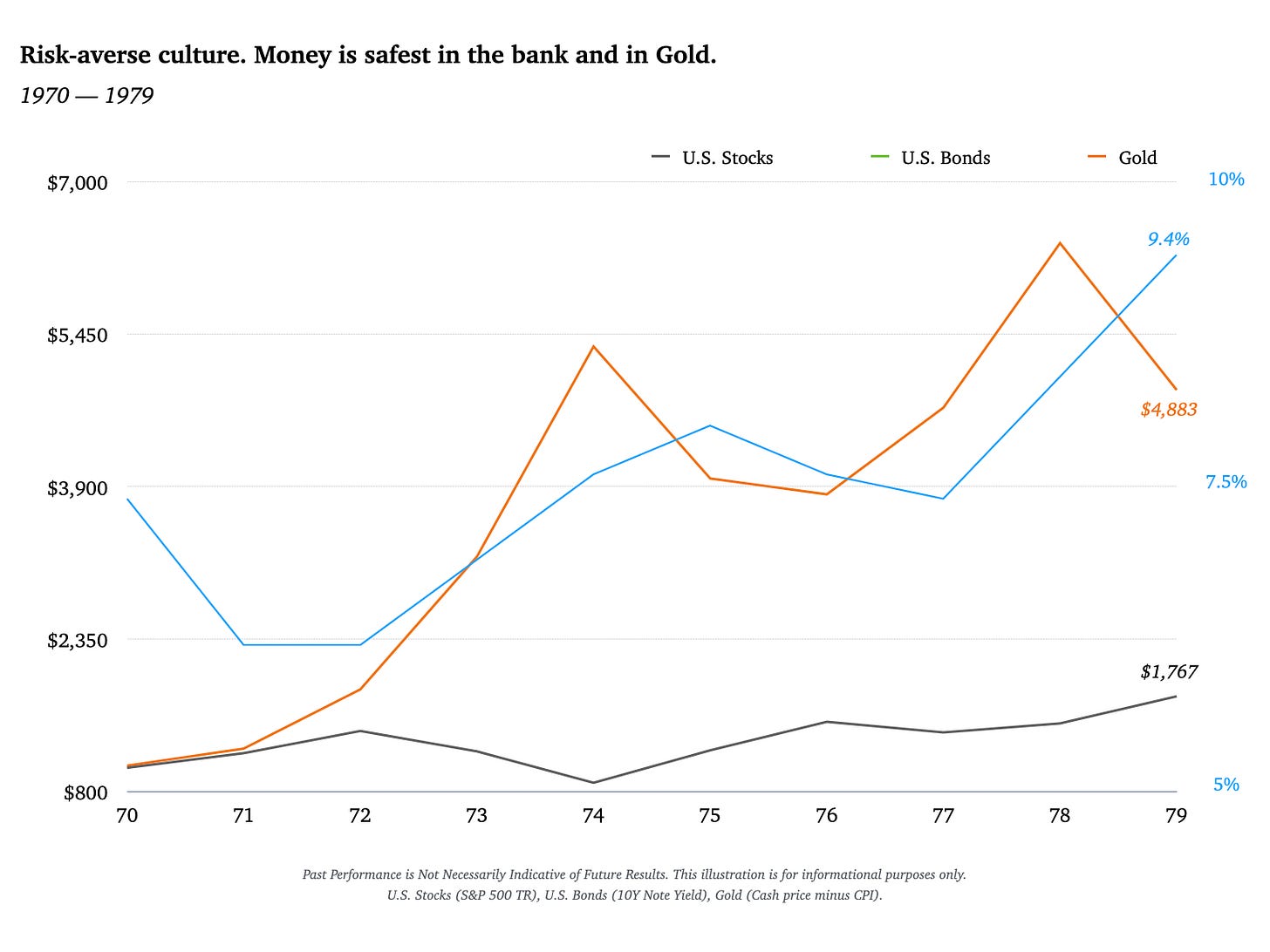

1970’s

If you started in the 1970’s, you might view gold in high esteem; that it always deserves a place in your portfolio. You probably always carry at least a slight concern about inflation. You value saving money. Your parents, after all, grew up during the Depression so appetite for risk wasn’t common. You believed that stocks weren’t the best place to put your money. Returns were sub-par and the decade included a couple of major drawdowns.

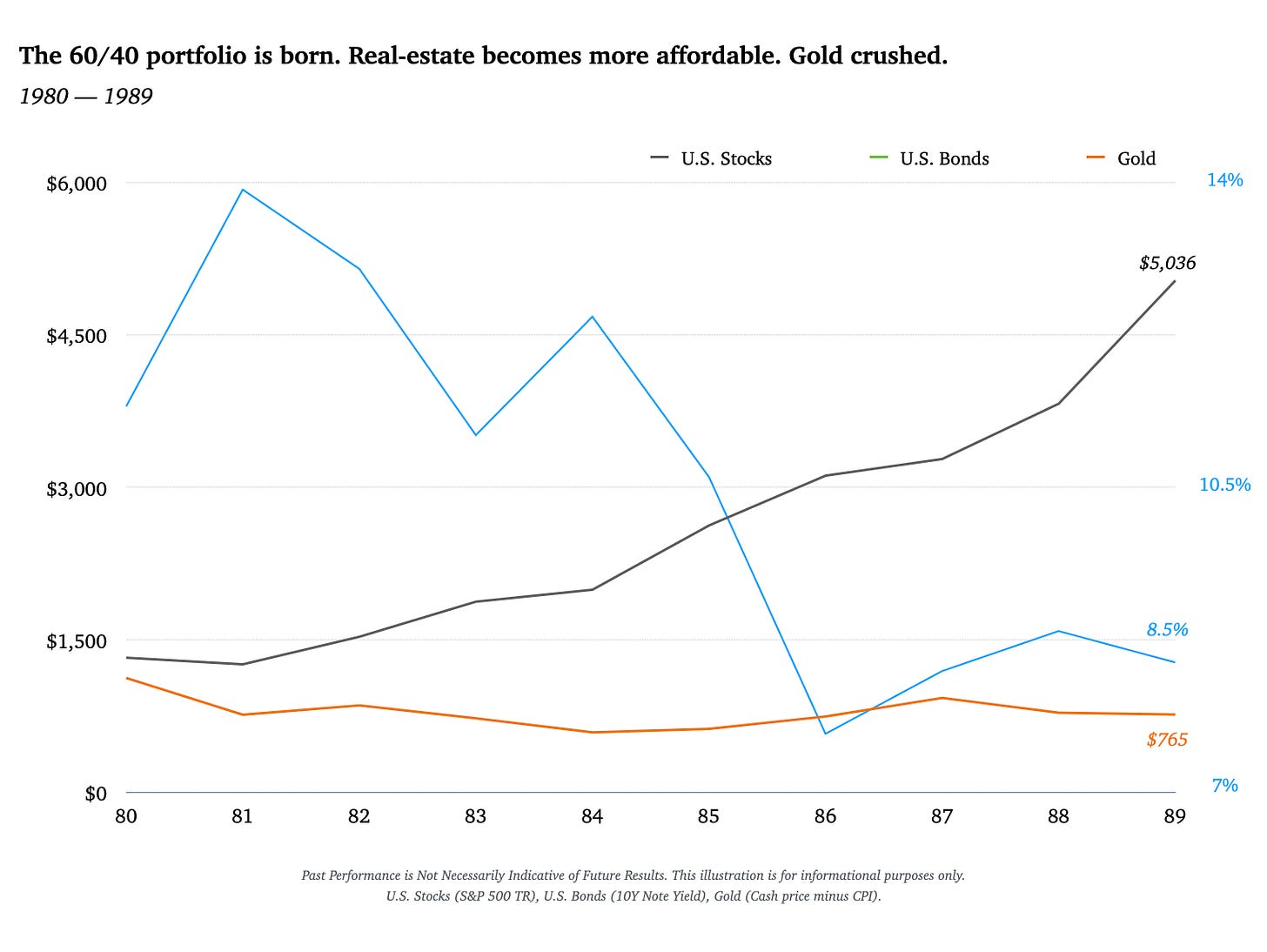

1980’s

In the 80’s, your worries about inflation took a back seat. Jacked up about the direction of the country, Reagan-ism and all of that, risk-appetite made a comeback. Technology was becoming an interesting place to invest as TV’s, VCR’s and mobile phones gained in popularity. Many great tech companies were actually just getting started during this time. As interest rates nose-dived, buying real-estate became an obvious choice; even formally making it a business. Gold, going through a major drawdown, fell out of favor. Uncomfortable with the amount of government spending, the old heads started worrying about the country’s debt and its affects on asset prices.

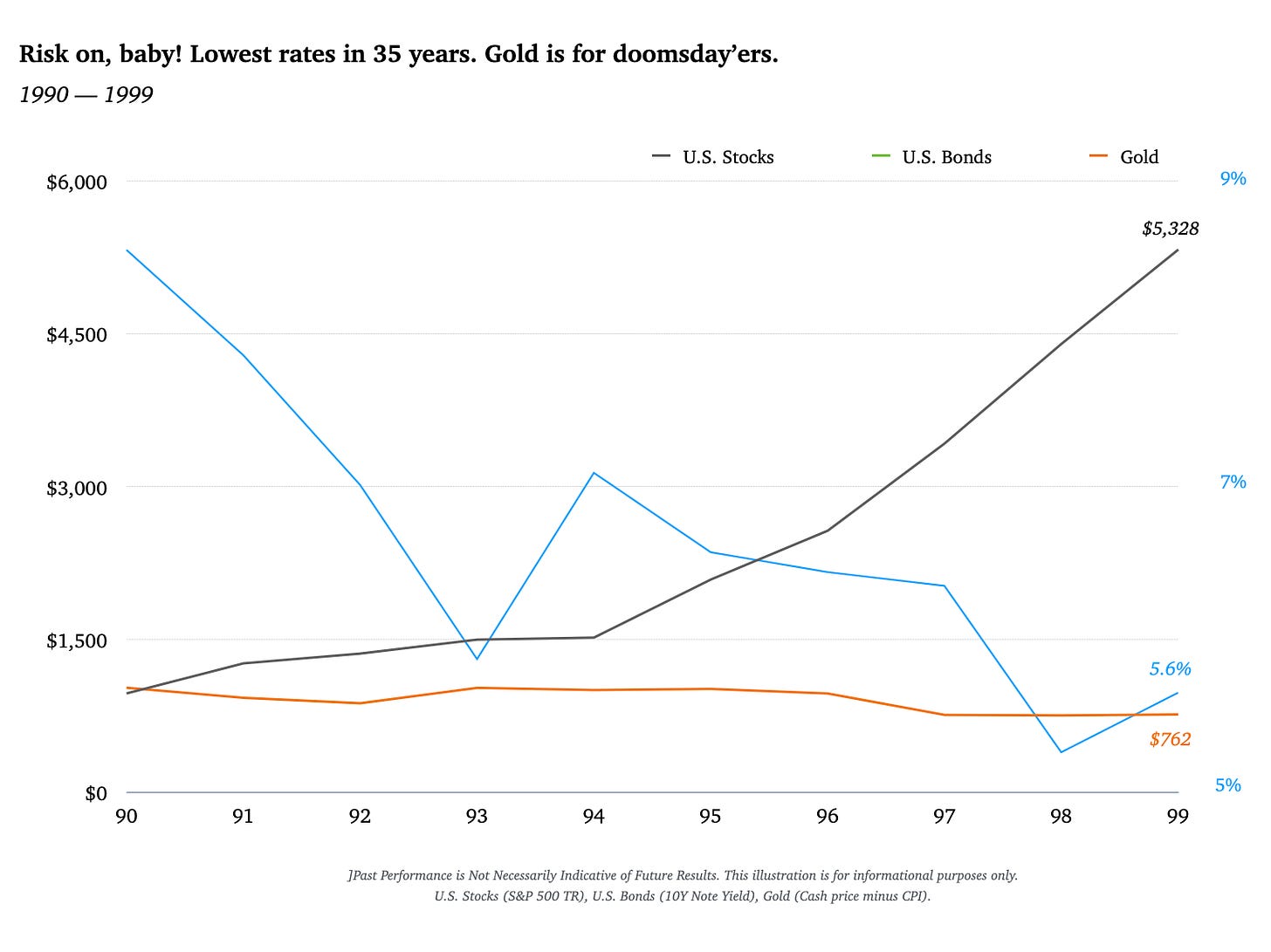

1990’s

The 90’s was party time. The technology cat was out of the bag. 1995 through 1999 was best five-year annualized return for U.S. Stocks in history. Investing was easy. You knew you had to max out your 401k and just keep buying stocks no matter what. Your entire portfolio had to be in stocks. Recessions were a thing of the past. Nothing can stop us. Food and energy was affordable. It was a time of abundance.

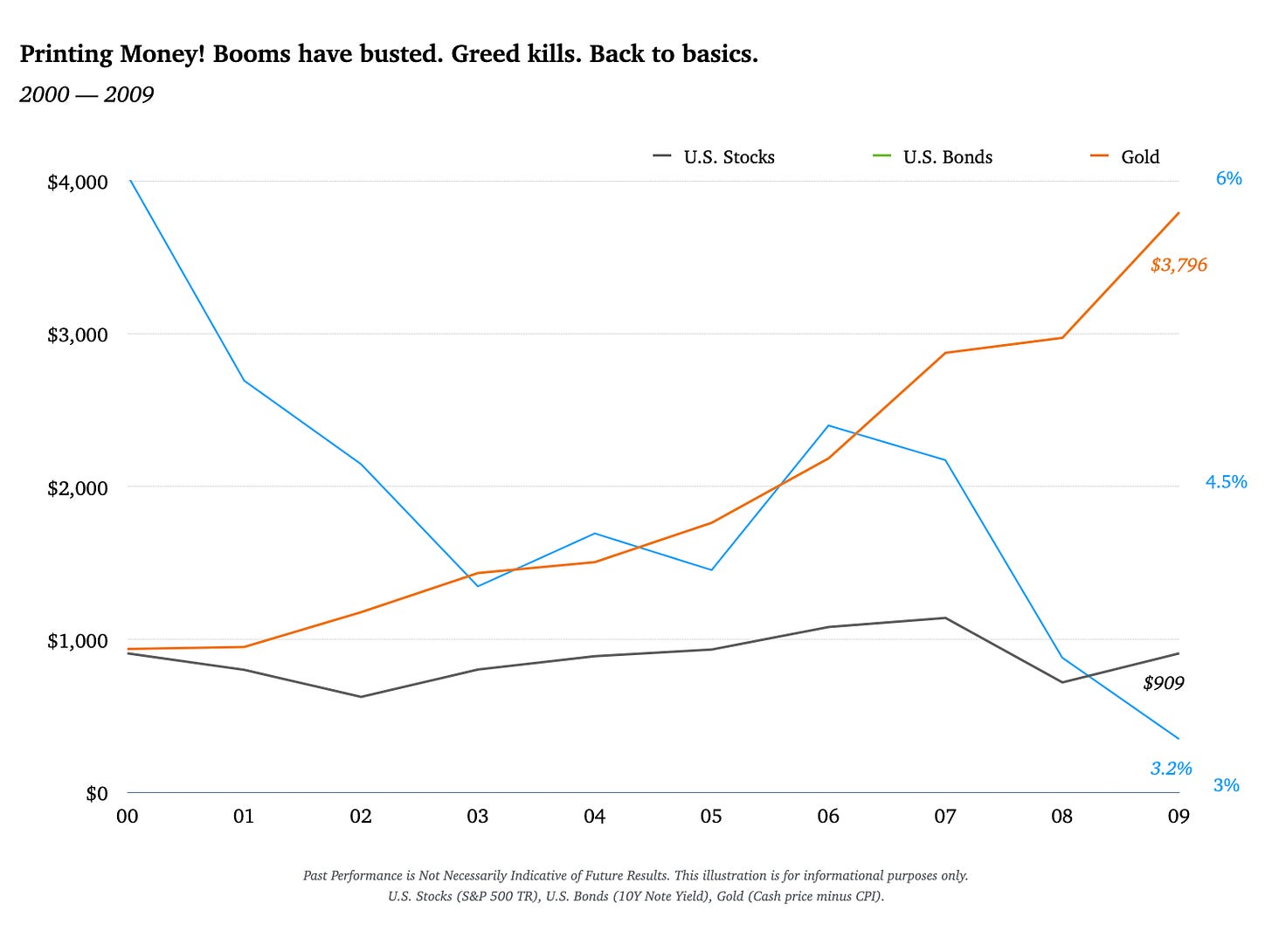

2000’s

In the 2000’s, you understood the importance of risk management. That good times don’t last forever. Diversification is a good idea. That stocks don’t always go up and being all-in on any one asset-class, especially high-flying tech stocks, bears serious risk. Real-estate became the primary investment in most households — to pay it down quicker and to always favor buying over renting. You learned that the government will bail out the markets during times of crisis. That dips should always be bought because the government will allow asset prices to decline that much.

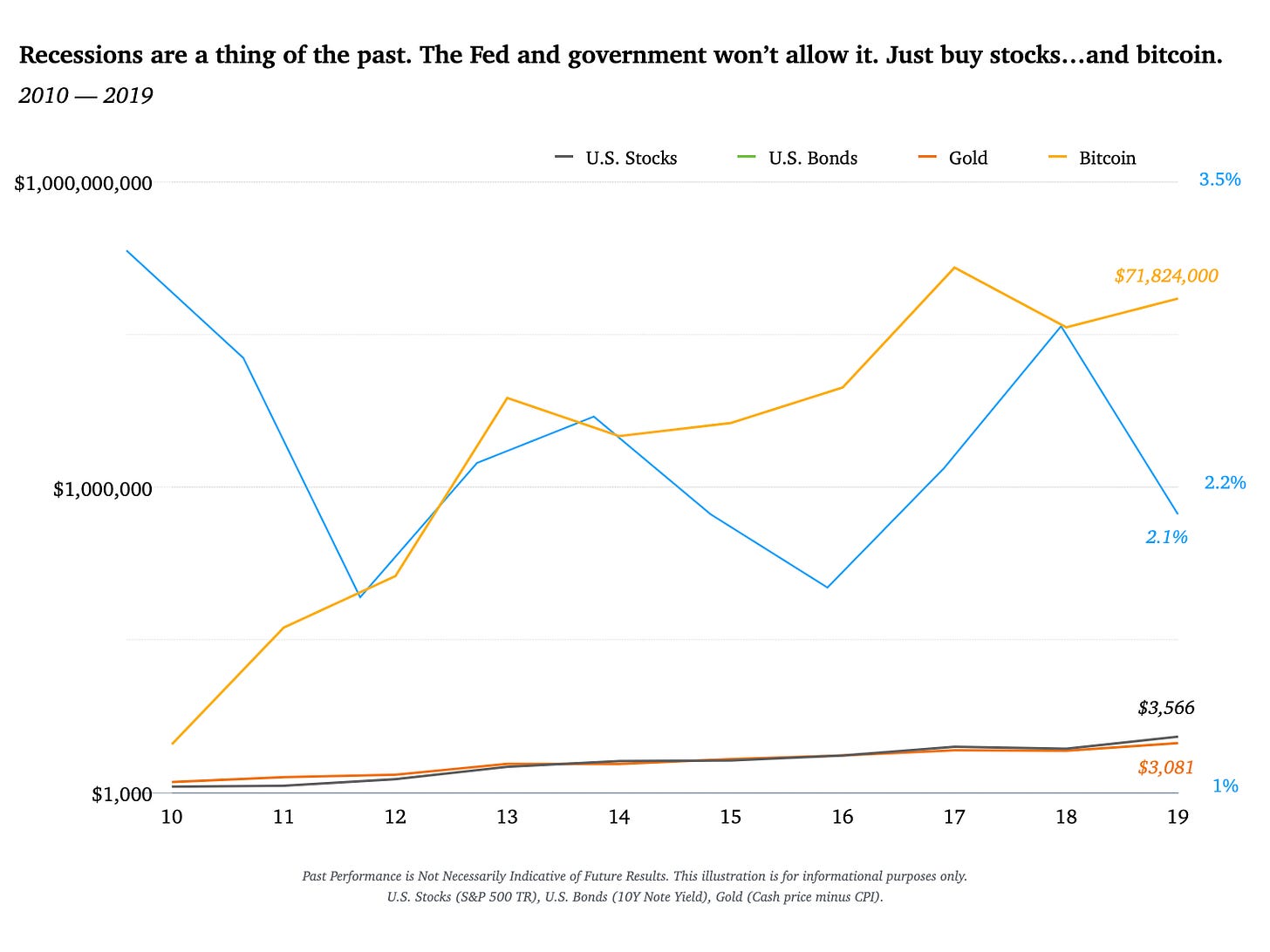

2010’s

From the 2010 thru 2019, you once again believed stocks are the end-all-be-all. That they should be the primary investment in your portfolio. You couldn’t earn interest at the bank anymore, so stocks became the obvious choice. Bear markets aren’t anything to worry about because, as we know, the government will show up on a white horse to save the day. So, just buy some index funds and watch your capital compound exponentially. Easy. And what’s even better is that you could do it all yourself from your phone. No need to pay an advisor or pay some overpriced suit at a premier broker. They, after all, were bailed out during the Financial Crisis so they’re not to be trusted as stewards of capital.

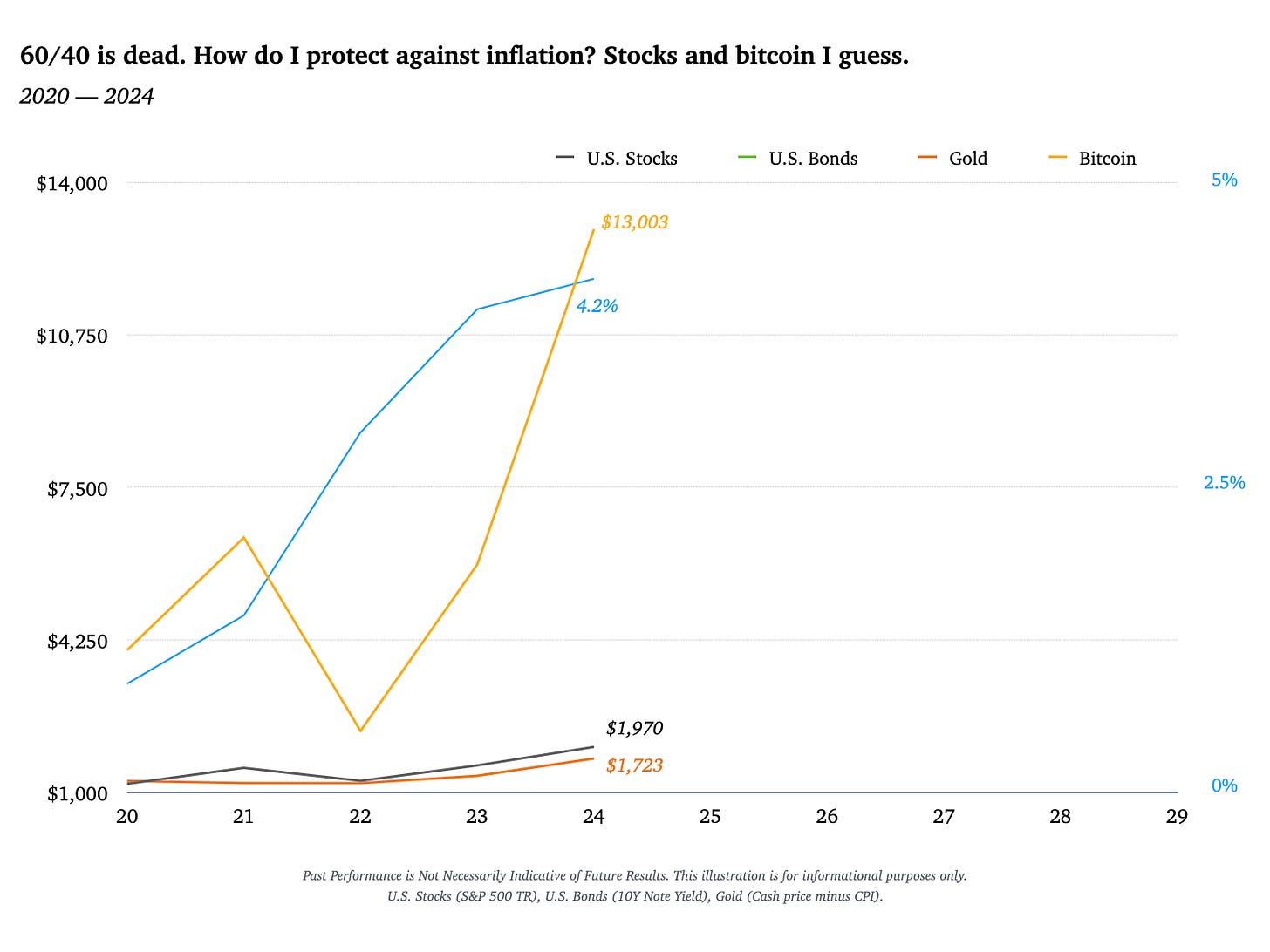

2020’s

So far in the 2020’s beliefs are more or less the same as the 2010’s. Investing is still easy. Except now, you worry about inflation. If anything, you might believe you have to take more risk. And what better way to do that than buy up AI stocks, crypto and MAG-7 stocks. Buying a house has taken a backseat given soaring prices and higher rates. Oh and you now have some doubts about holding bonds in your portfolio because they might not serve as a good hedge against falling stock prices. They failed to do so in 2022. You also believe the U.S. Dollar, and fiat currencies in general, are going to zero so Bitcoin is a viable place to keep your money safe.