Where we are might serve as a pretty good indicator of where we’re going. The trick is to actually observe what’s happening, not what’s being said.

Fundamentally speaking, which I’m not very good at in the slightest but I’ll take a shot at summarizing the current environment — we have inflation figures declining around the world, rate increases slowing down or pausing altogether, the dust settling on the recent regional banking crisis, a surprise cut in production by OPEC, a weakening U.S. Dollar and strengthening equity markets.

The upcoming events that markets are focused on are the Jobs Report tomorrow April 7th and earnings season which kicks off next week. If jobs figures come in as expected or better, then markets believe that the FOMC will have the data they need to start pausing rate hikes and even lowering them again.

Talk like this (the previous two paragraphs), and much more complicated talk on television and at money management firms around the world carry an effervescence. People eat it up. It makes them feel like they know what’s happening, why and what’s going to happen next.

Once in a blue moon, someone gets it right but relying on words instead of trends will eventually get you killed. We saw it recently over the past few years in crypto, covid and meme stocks, HFT’s and startups. It’s still unraveling in some of these areas.

Talk is cheap. It doesn’t pay the bills. We must do. We must respect the markets. We must act when things change. It’s hard to do because it forces us to say, “I was wrong” or “I change my mind”. Just look at politics these days, everyone is right about everything. No one changes their mind because they’re not open to objectively looking at things. No one ask questions because everyone knows the answers.

A recession is a sure thing, huh? And that means equities are surely going to get killed like they did in 2022?

Inflation will rage on and the FOMC will continue raising rates? What if they do, but the long end of the curve moves the opposite way?

Investors will rush to the safe U.S. Dollar? Maybe. That’s been the historical pattern, but what if they don’t this time? What if they don’t need to run to safety because things aren’t as bad as you think?

************

Let’s stop talking and look at what’s going on.

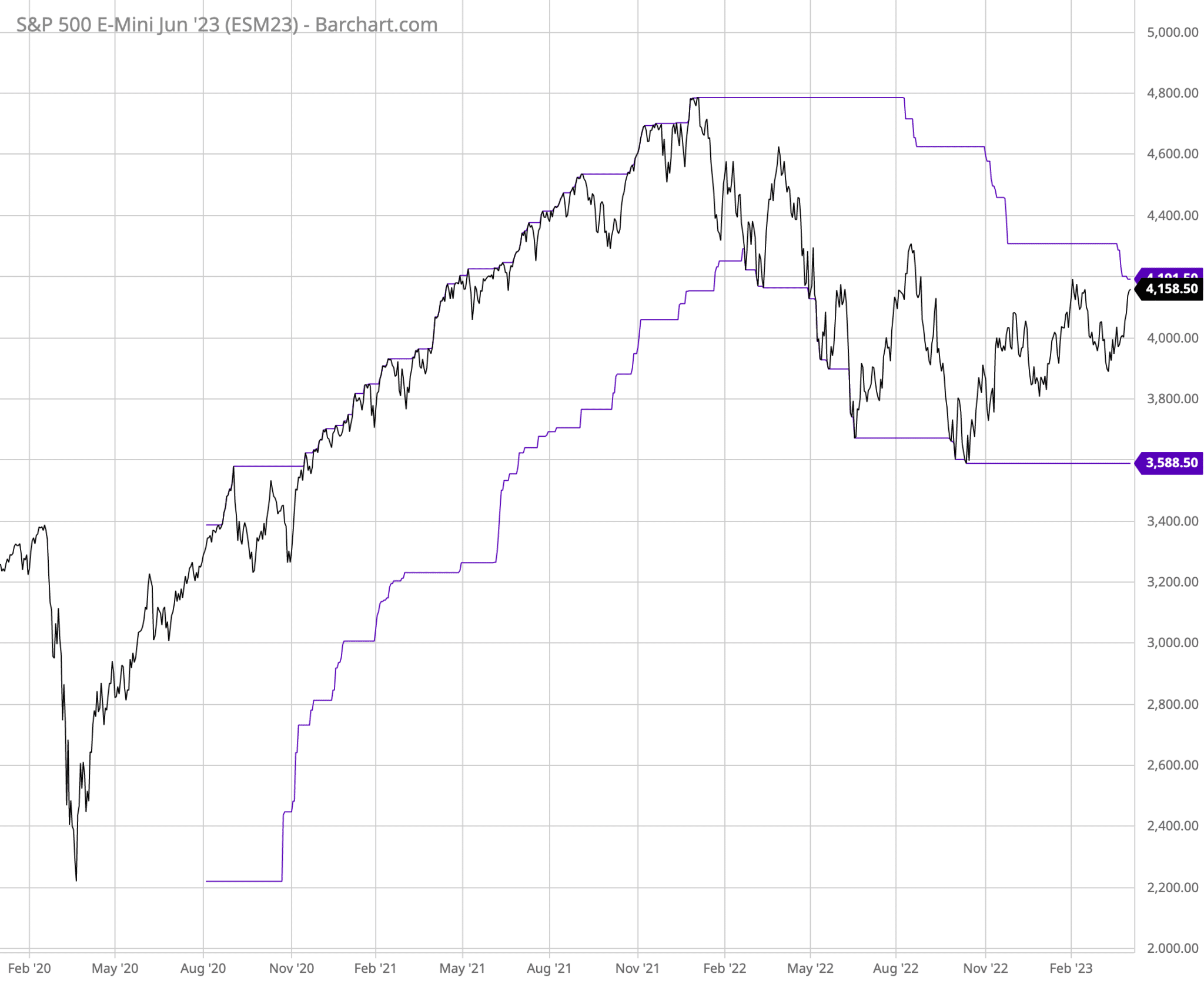

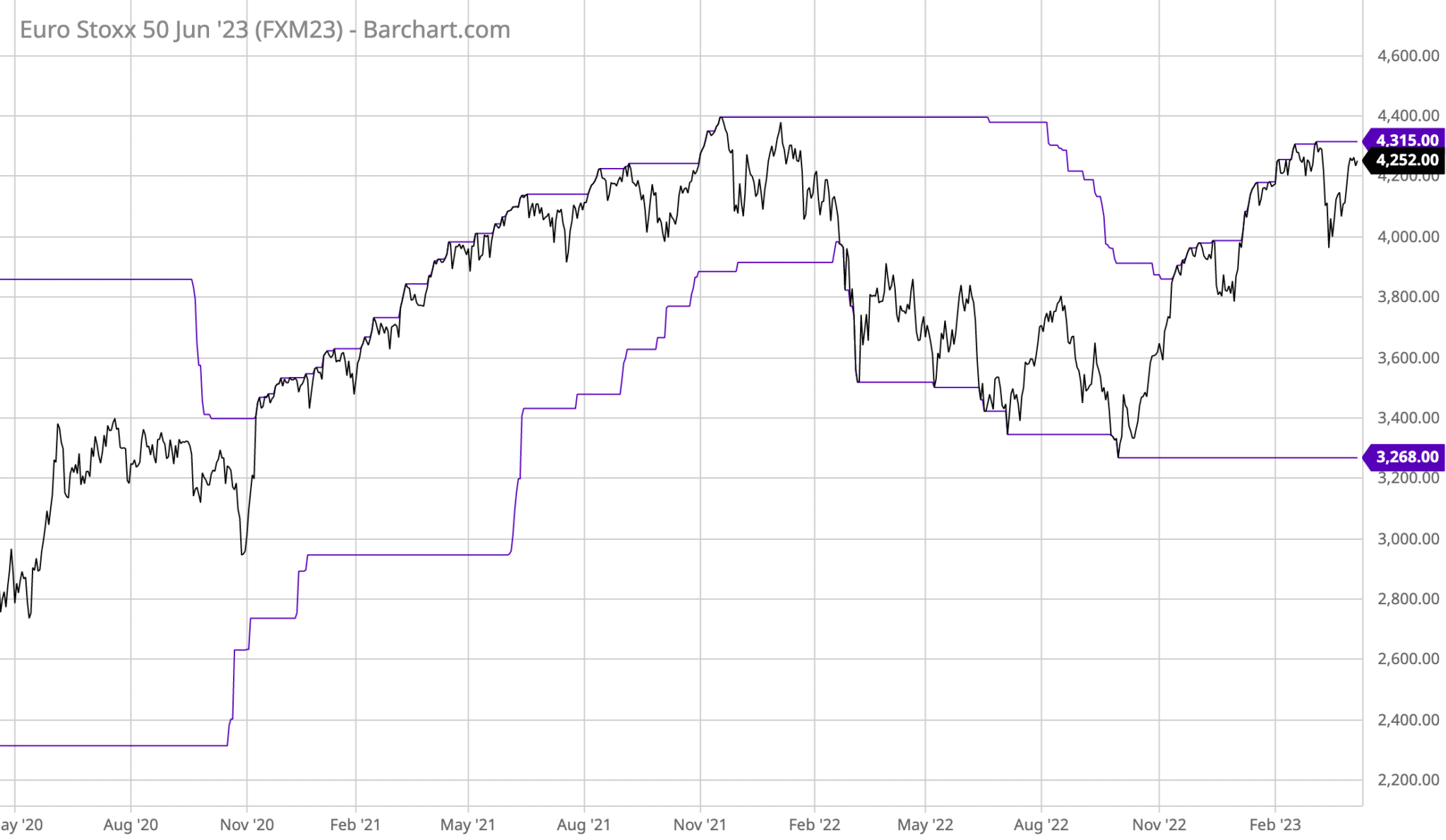

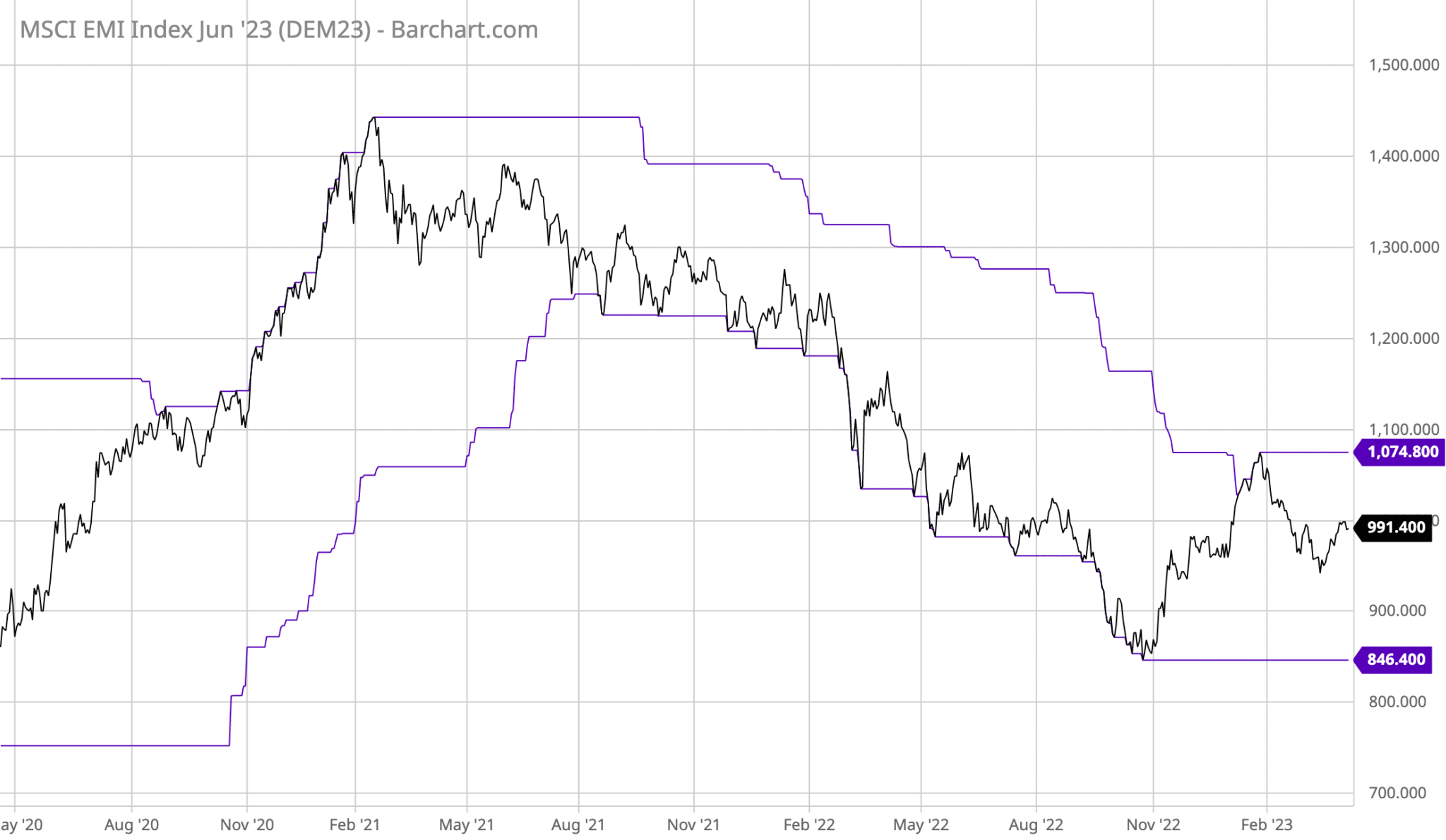

Equities

Banking crisis, tech bubble 2.0, inflation. Oh my.

U.S. Equity indexes are nearing six month highs. Europe already broke out months ago. Emerging markets broke out as well, but have had trouble holding above those initial breakout prices.

Recession incoming? Maybe. Maybe not. Maybe the markets have already priced it in and are now pricing in the revival.

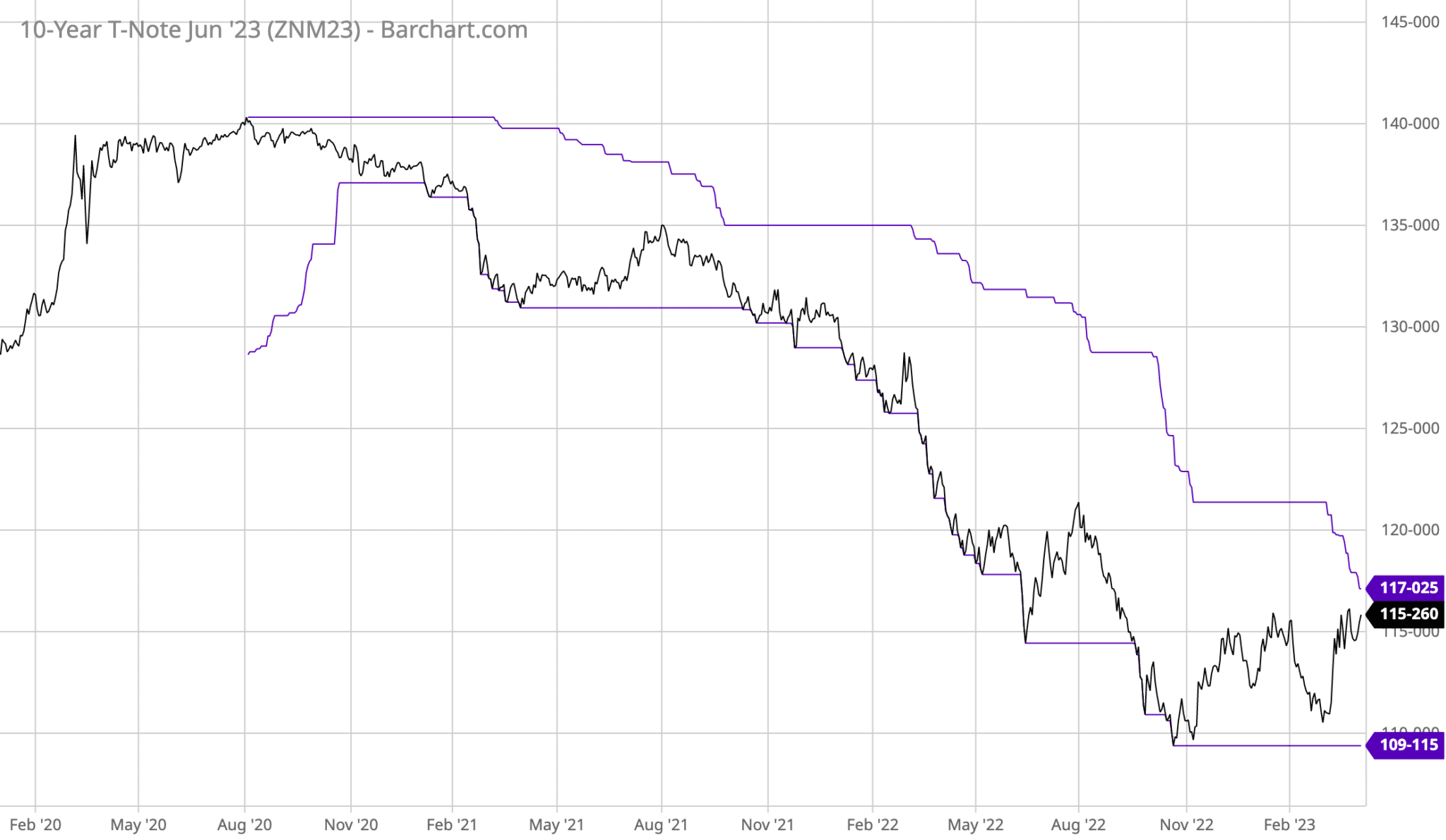

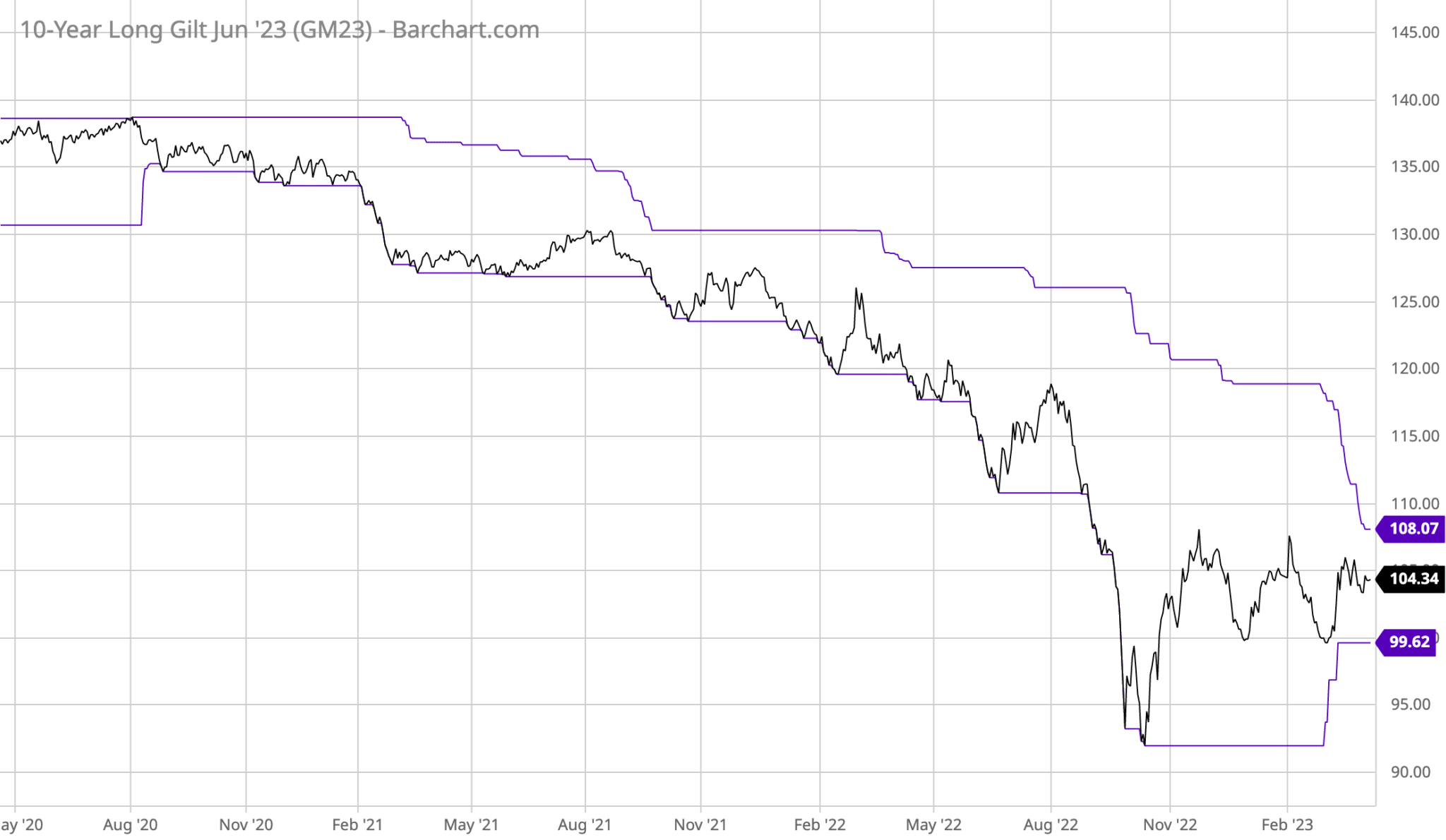

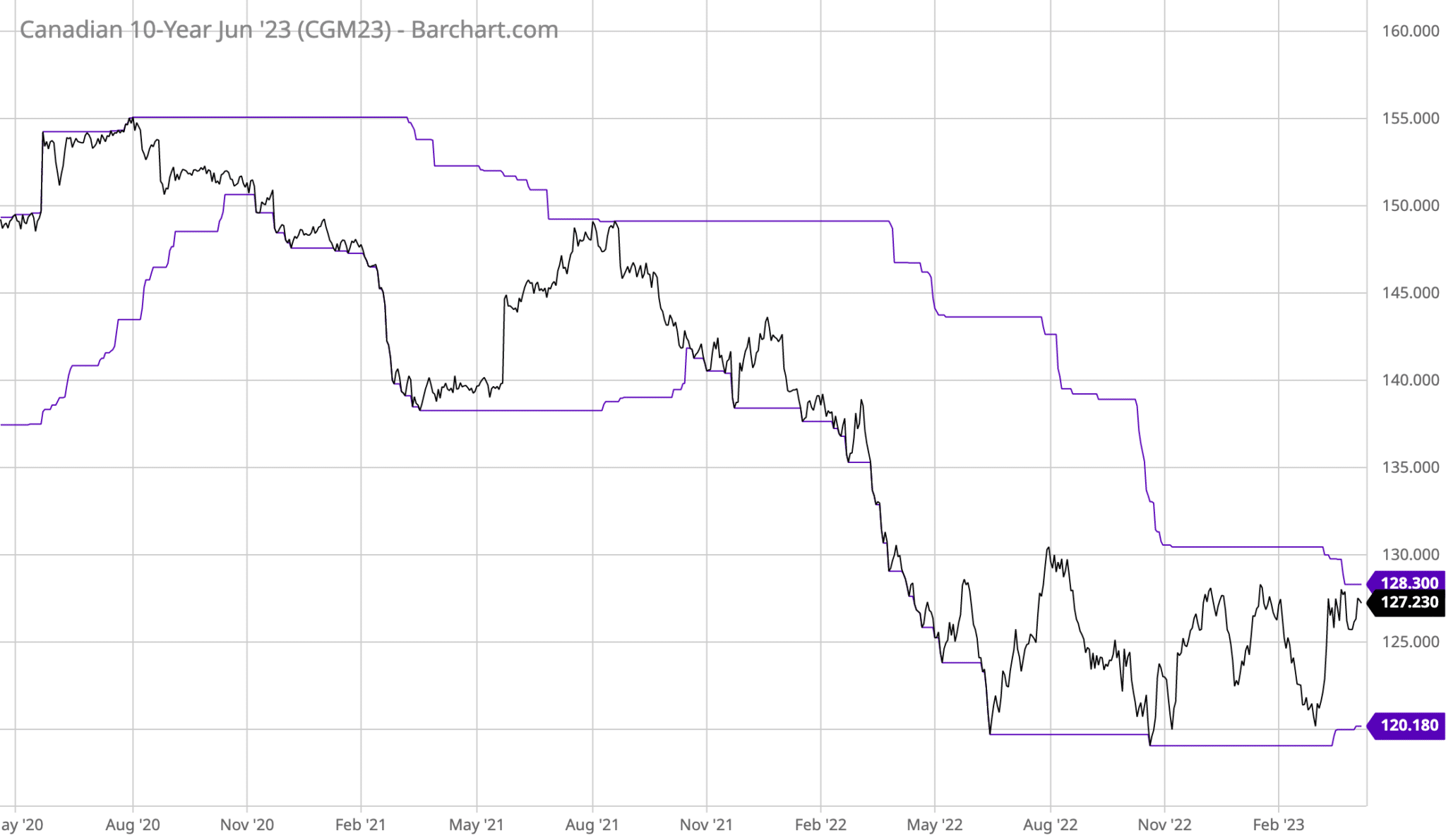

Fixed Income

The long-term trends remain down, but we’ve seen consolidations over the past several months. Many government bonds are closer to upside breakouts than showing signs of going back down again.

The downtrend in 2021-22 was damn beautiful though. Perhaps they resume, but I think new uptrends are in our near future.

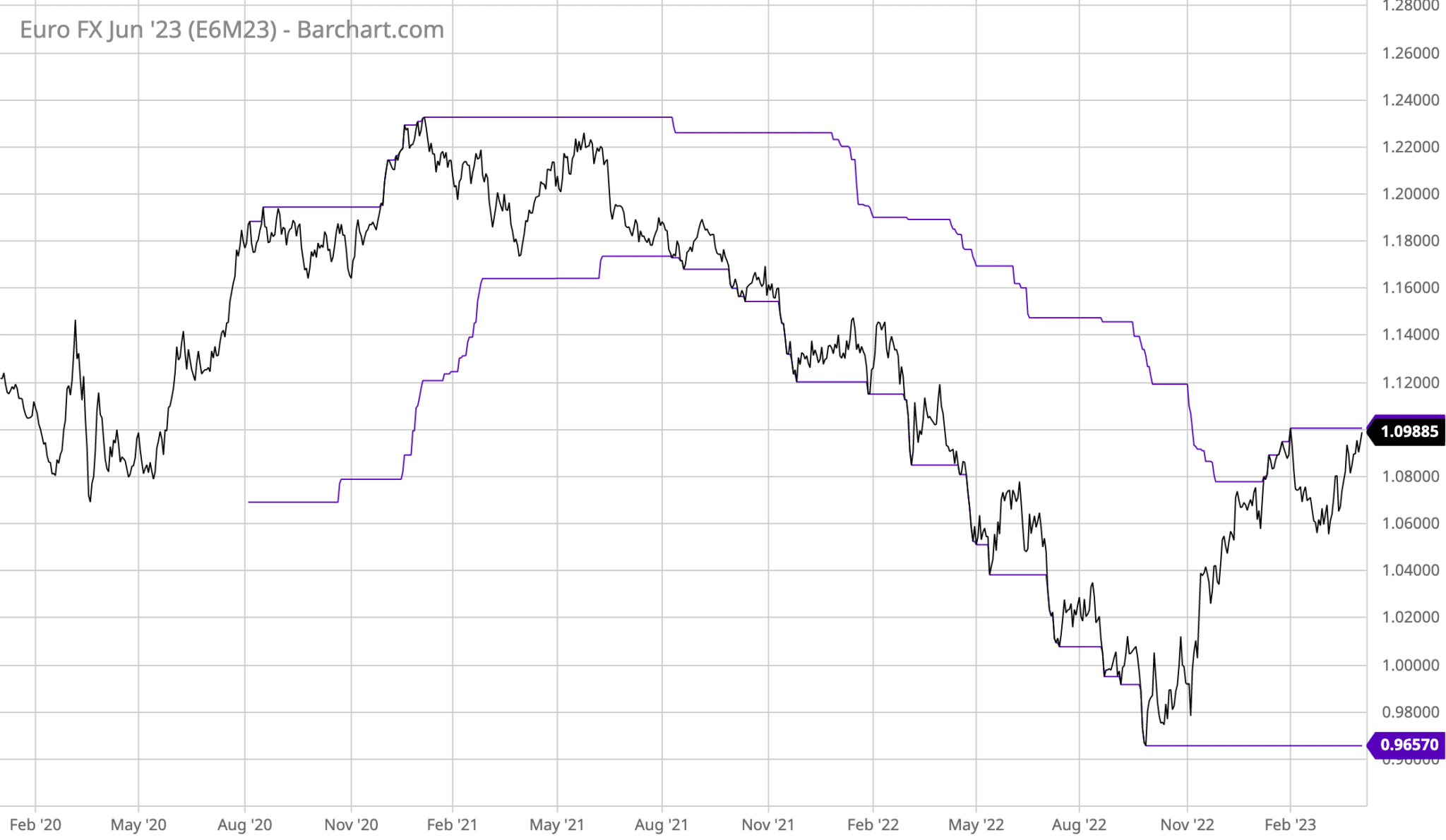

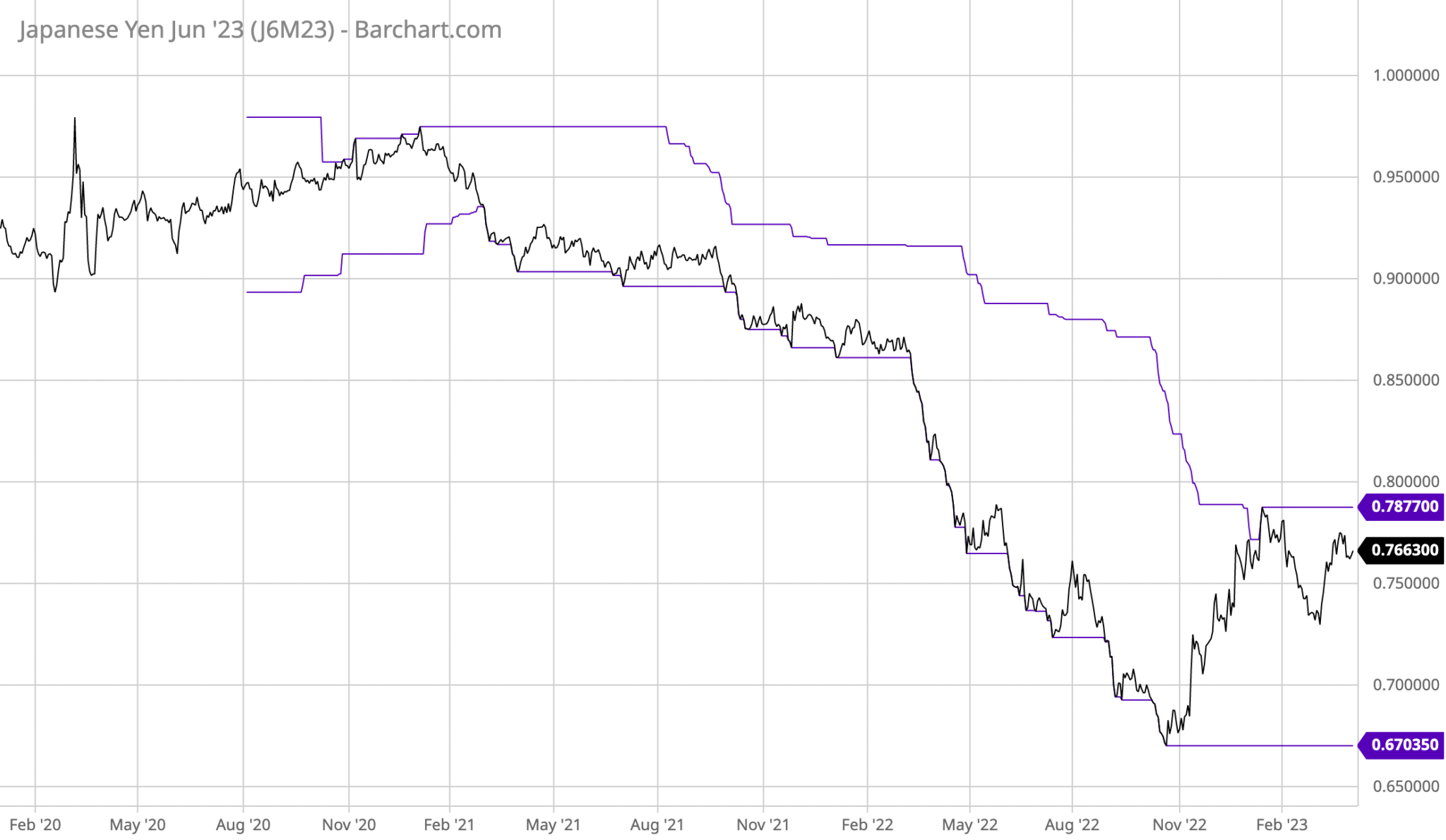

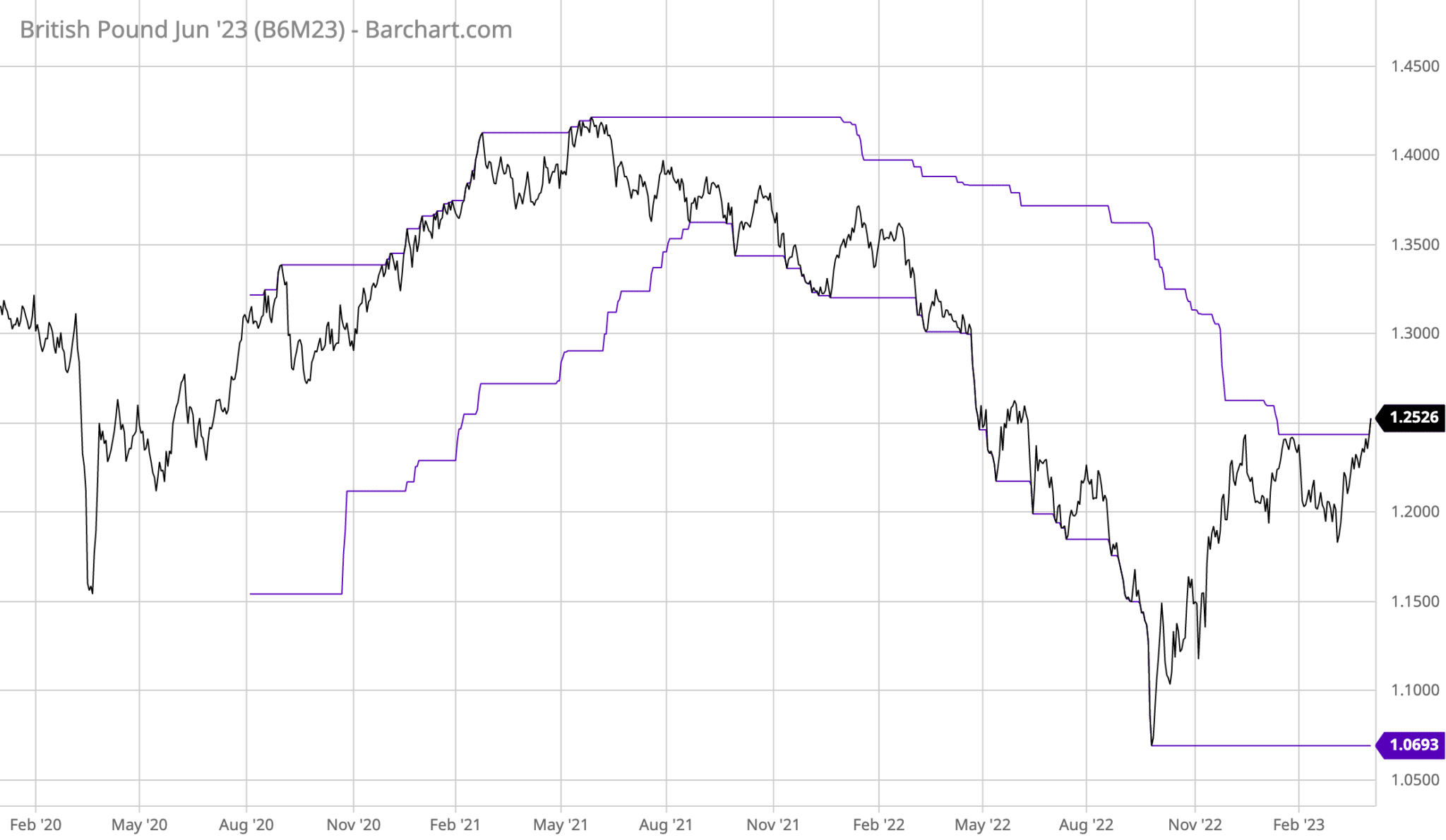

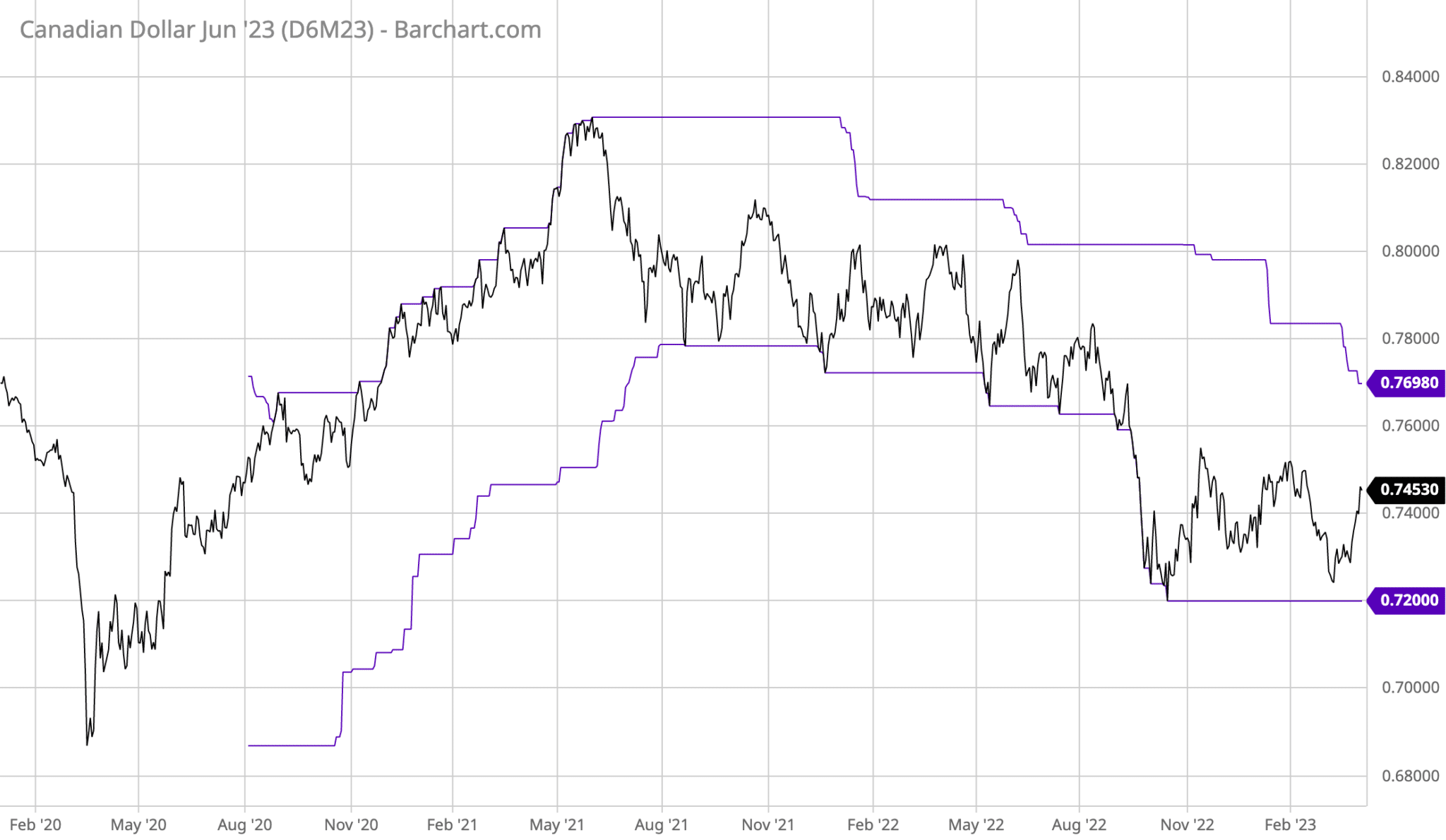

Currencies

Similar to bonds, many of the downtrends in major currencies are coming to an end. Letting go of the narrative of the past two years is vital for capitalizing on upcoming opportunities.

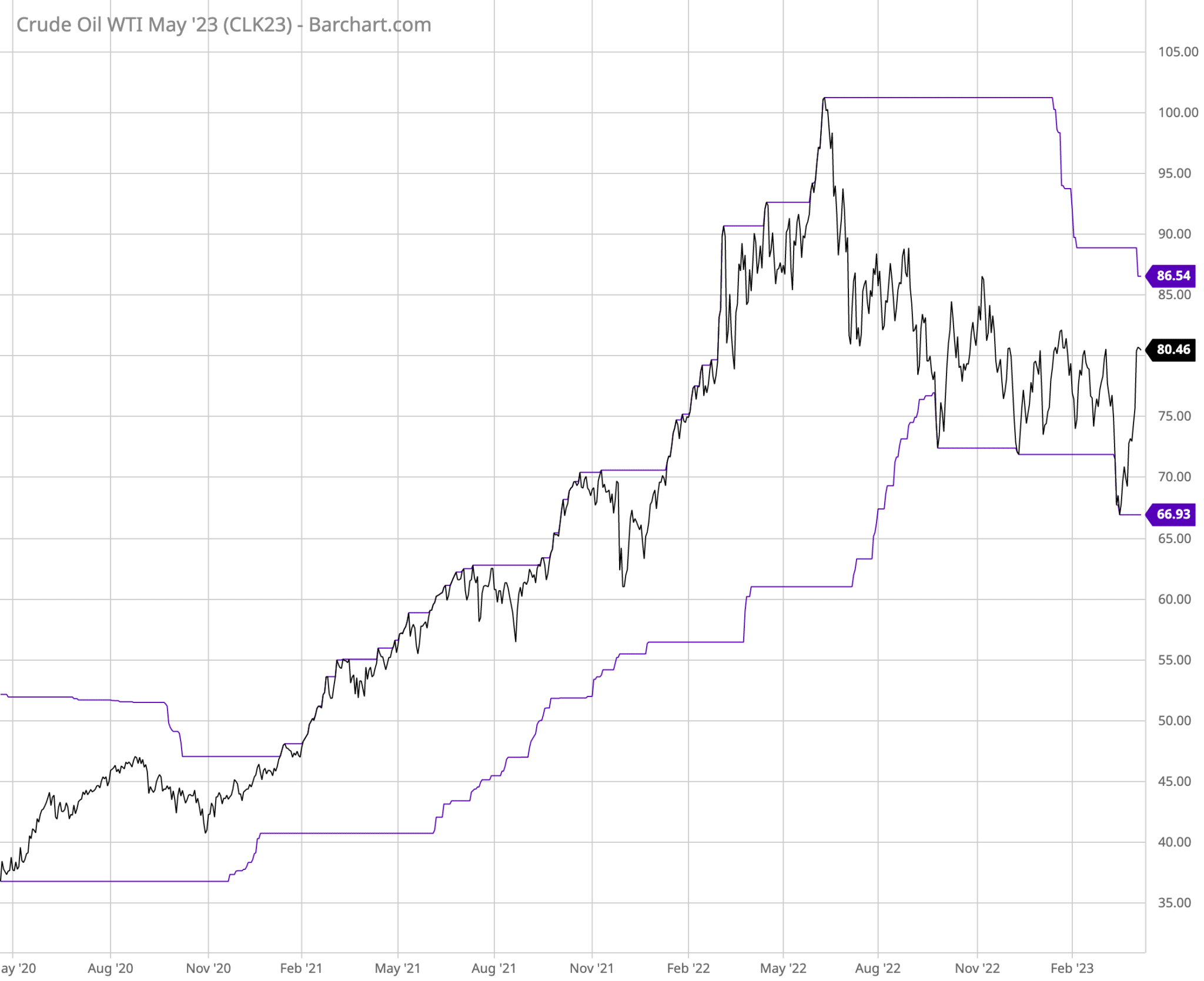

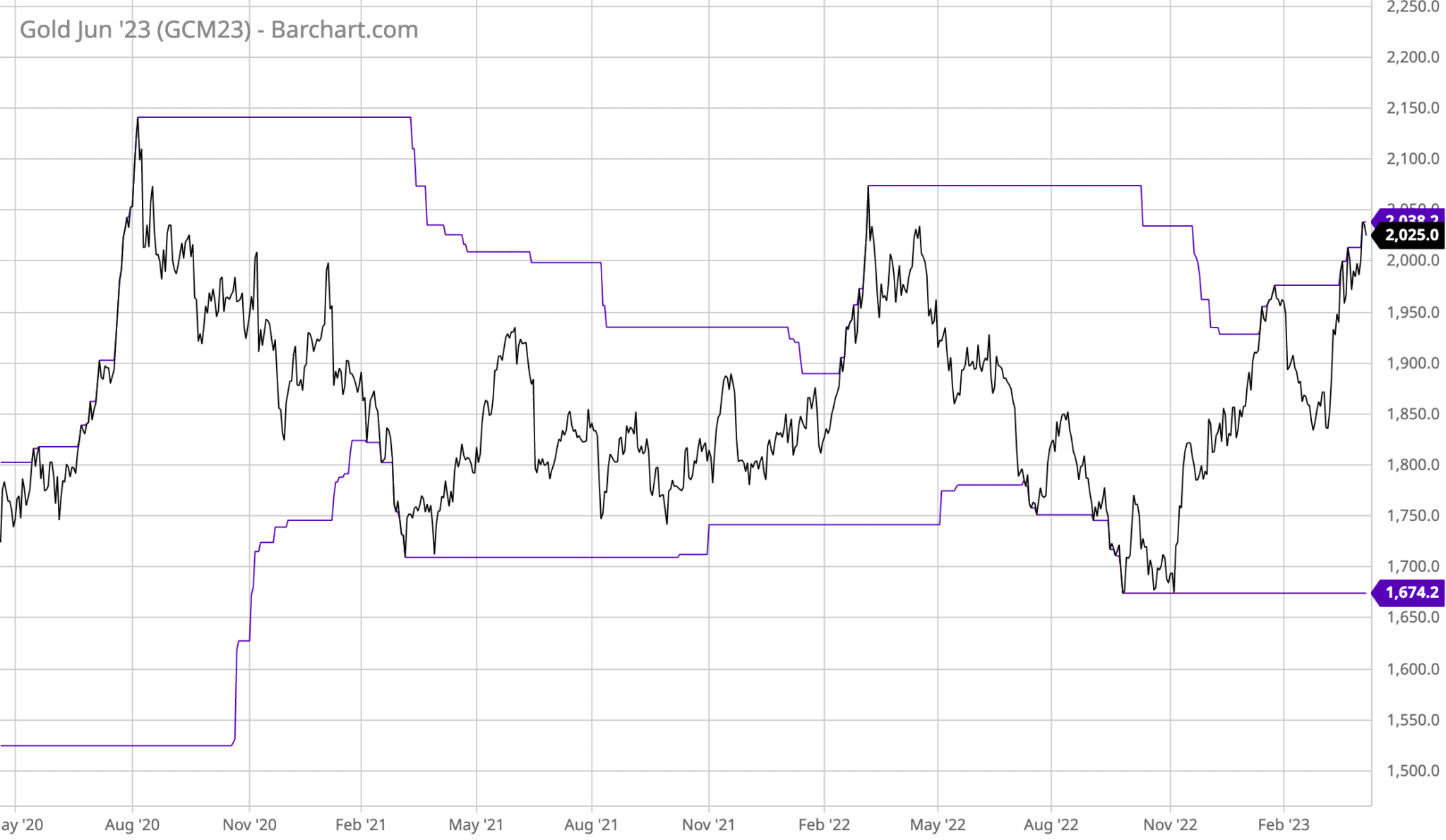

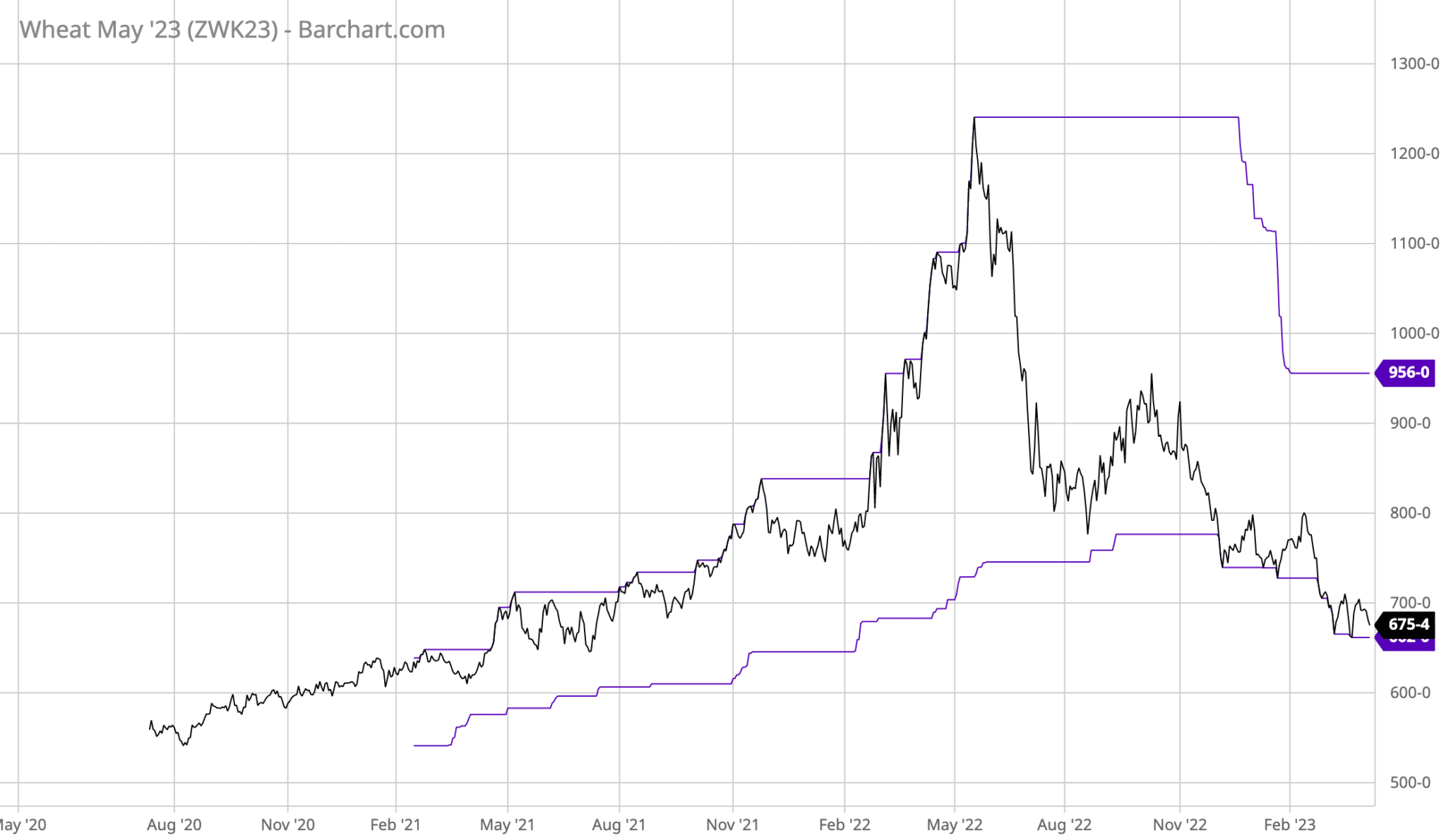

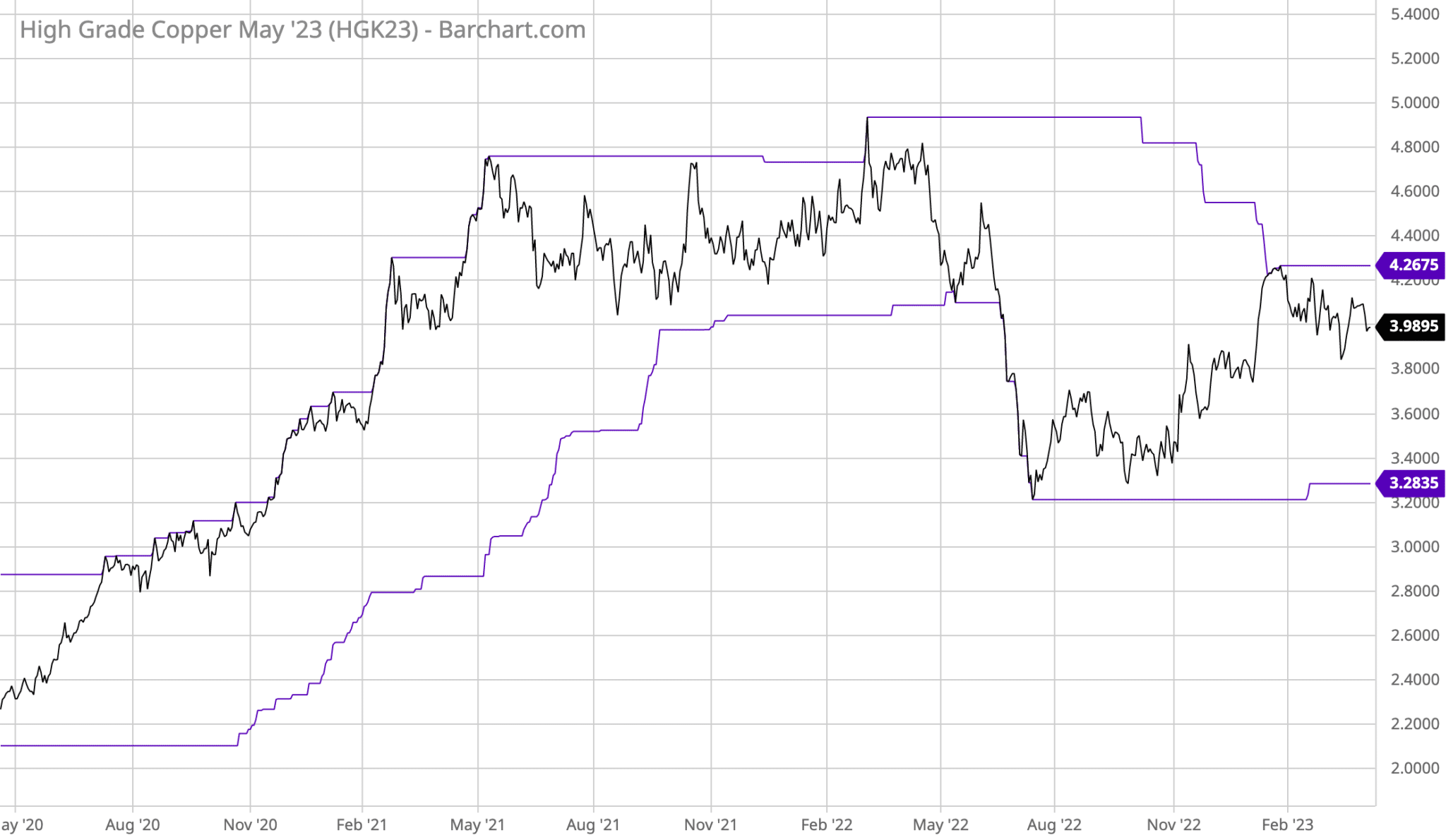

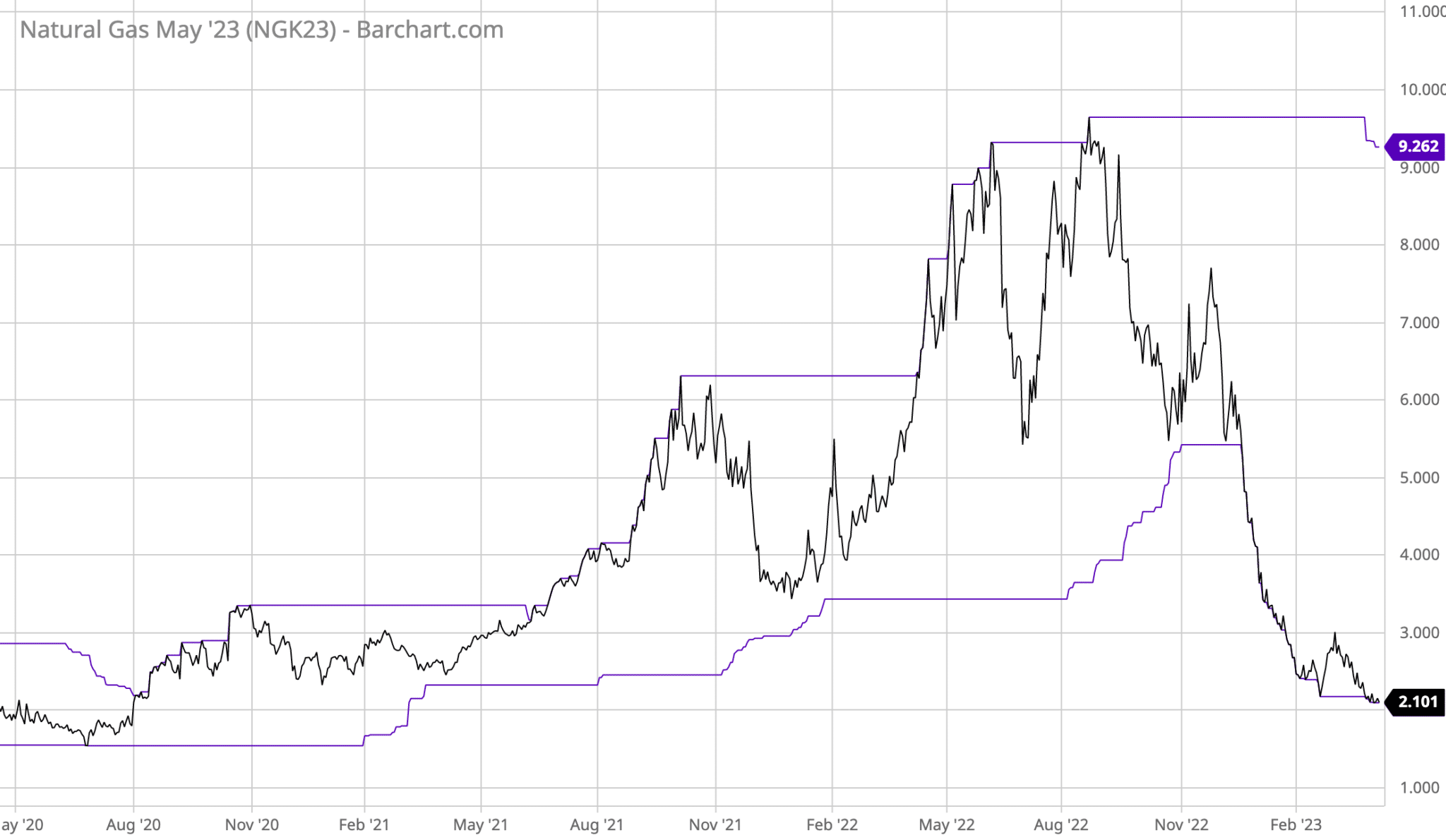

Commodities

A mixed bag. Some are going up. Some down.

Oil refuses to stay down. Same with Copper. Gold is breaking out again. Wheat, and many other grains, remain in downtrends. Tropicals, such as Sugar and Orange Juice, are making new highs.

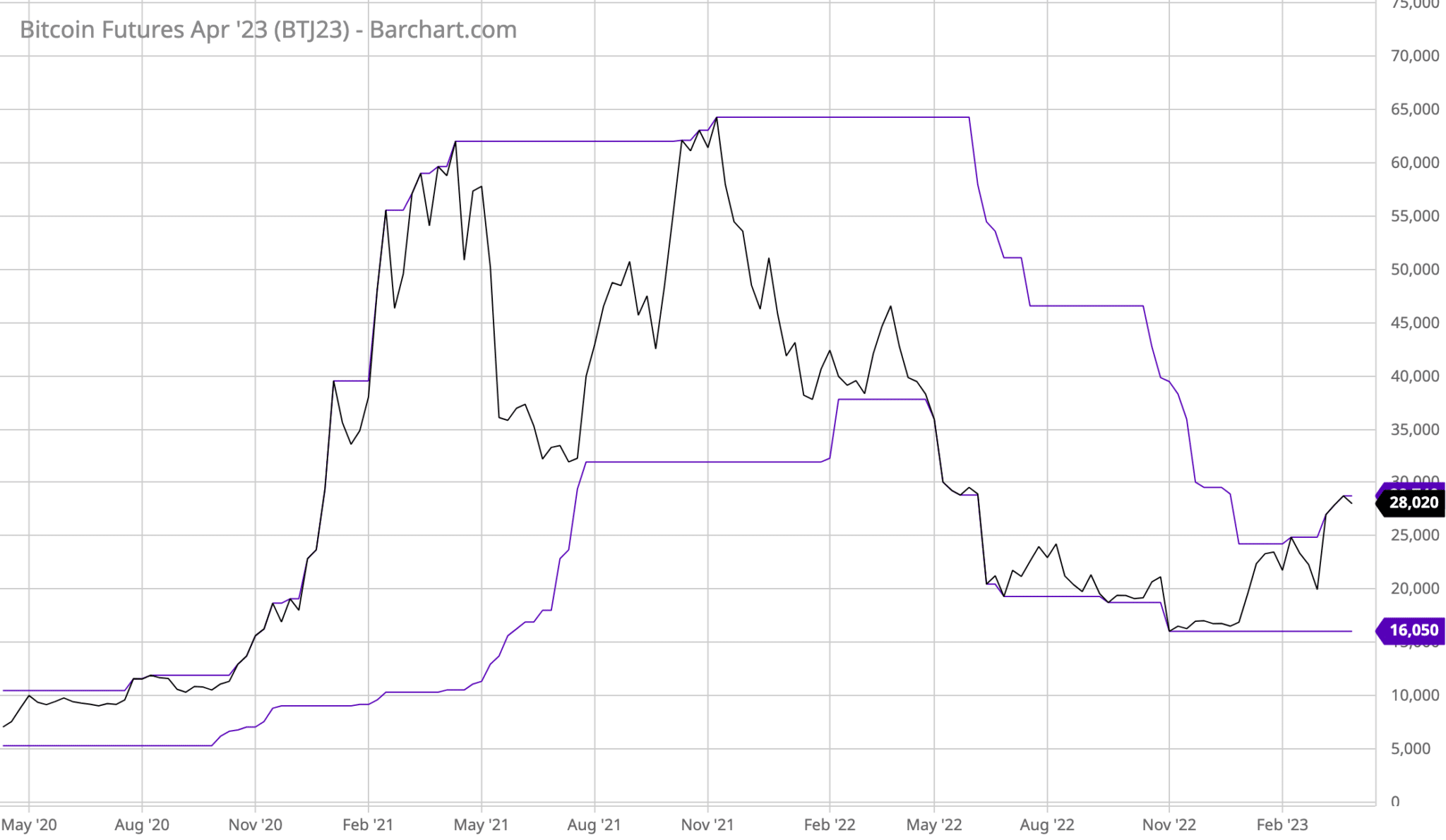

Crypto

New uptrend in Bitcoin.

Disclaimer: Past performance is not necessarily indicative of future results. Futures trading is risky. This communication is for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial product, an official confirmation of any transaction, or as an official statement of Melissinos Trading LLC. All information is subject to change without notice. These charts show examples of trends. Inclusion of a chart as a trend example does not imply any kind of recommendation to buy, sell, hold or stay out.