Over the past few weeks, trend-followers have likely been whipsawed out of many positions and initiated new ones. It’s times like these during intense volatility when the urge to indulge your feelings creeps in.

“Let’s scale back.”

“Things are crazy right now. Can we even trust this new entry signal?”

“This move only happened because [yada yada yada], so let’s wait a bit before exiting or entering.”

“These moves can’t last. Let’s wait until things calm down before we make our next move.”

All of this kind of talk seems logical (dare I say familiar?) and of course it feels good. Who the hell wants to obey the rules that have cost you money recently?

But this is where they separate the men from the boys. The men show up and do the work regardless of how they feel. The boys suppress their feelings and sell out to them, thus putting them into chaos.

“We’re in a drawdown! What do we do!?”

The system. The answer is always that: the system.

Do the Trades, Especially When You Don’t Feel Like it

To help hammer home the importance of sticking with the system through tough times, let’s go back to the 2015-17 period for trend-following.

The large trends in energy and FX came to an end and entered a long period of chop.

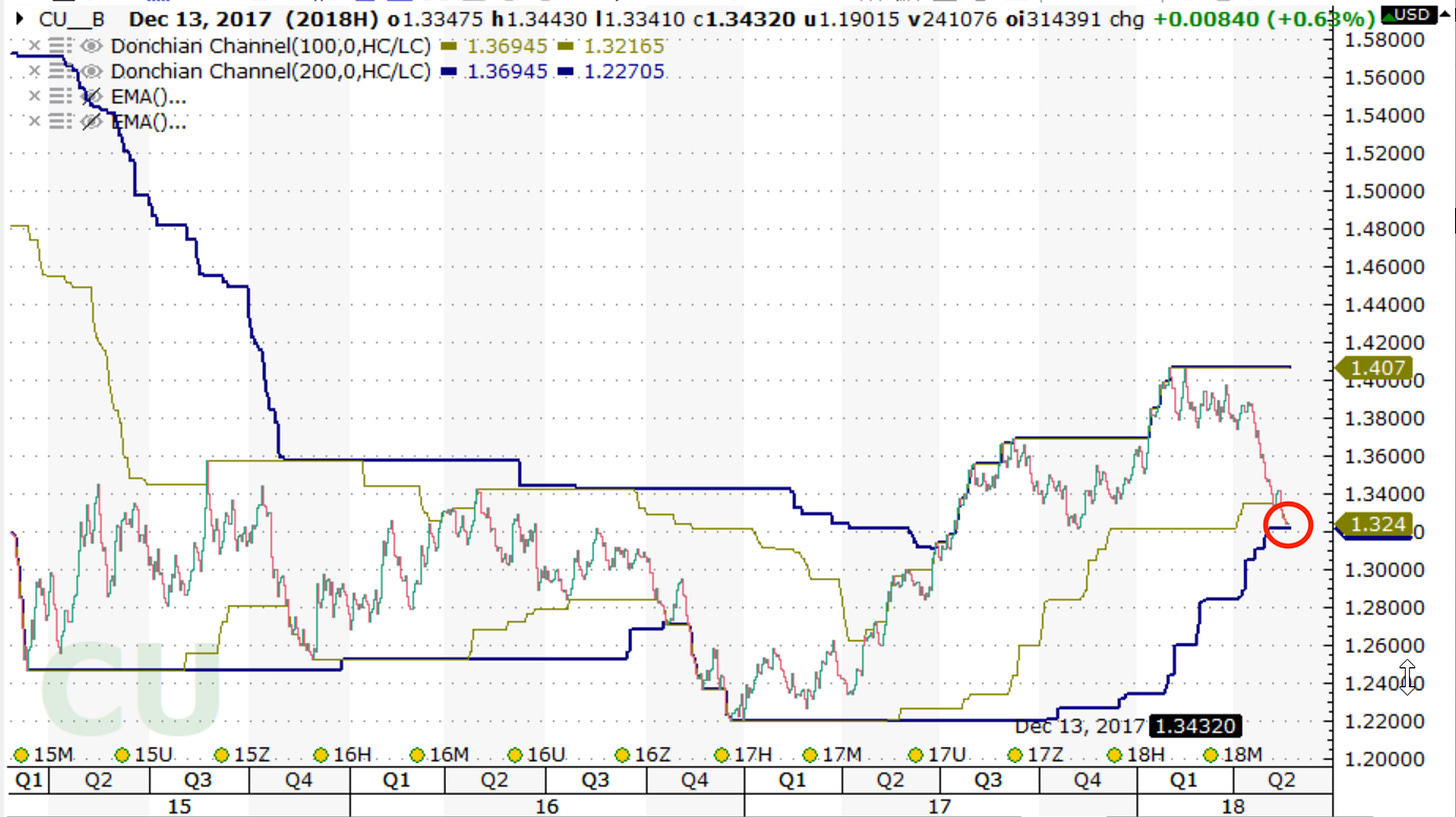

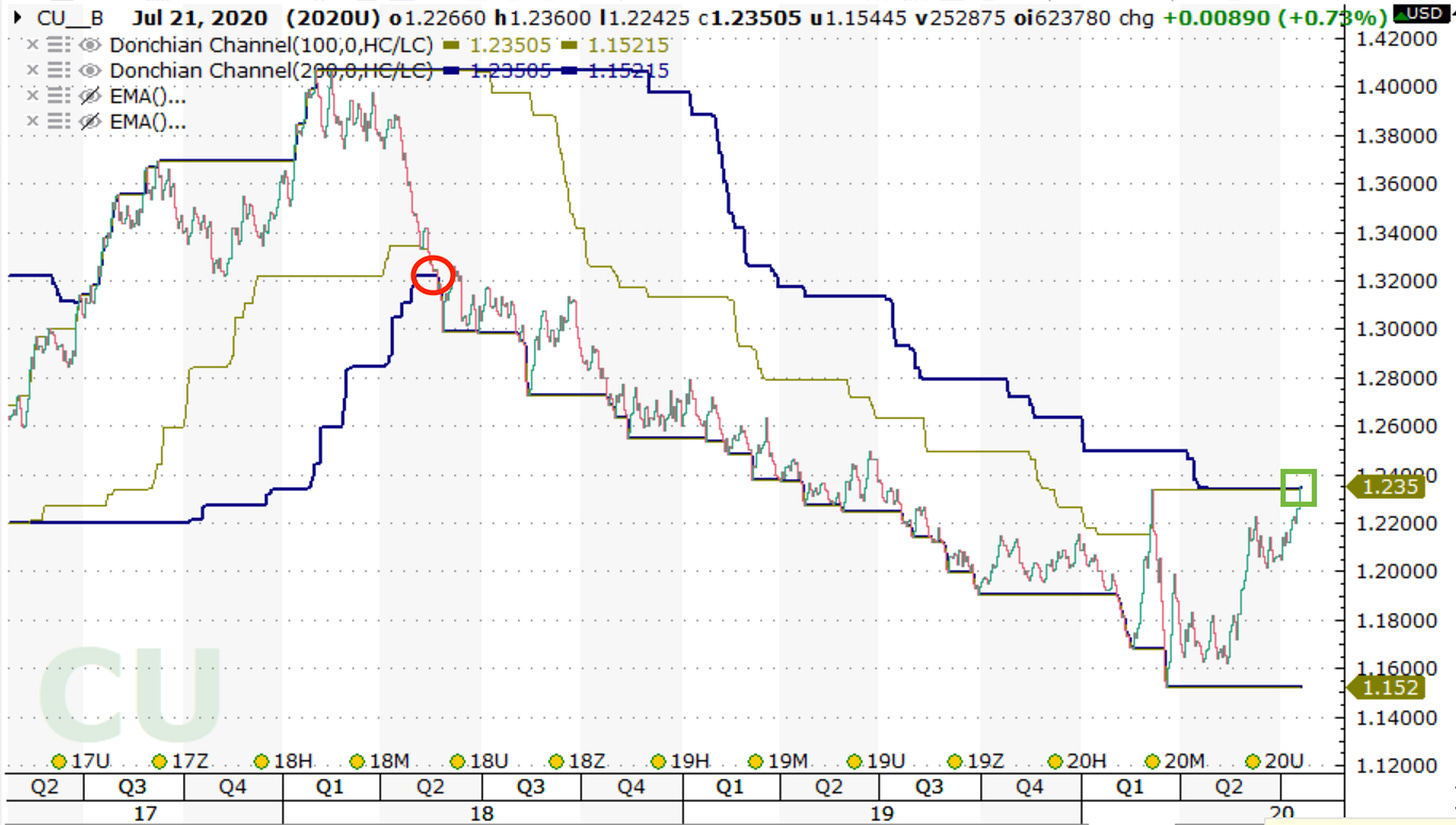

In 2018, as drawdowns piled up and patience wore down, it was time to get back short the Euro (shown below) and other FX markets.

Feelings of “this won’t work”, “I’m just going to get whipsawed again” and “Ugh I don’t want to” naturally come up. It’s imperative to feel it and do the trade anyway.

And wouldn’t ya know it, a big multi-year trend ensued.

Opportunities sometimes come in times of great stress. Trend-followers accept this and pounce when new ones present themselves. Waiting for them to develop is OK, but when they do, trend-followers do not hesitate. They get back in. Doing so is vital for long-term success.

It takes character to keep getting back in, especially when you’re stressed and bloodied.

Disclaimer: Past performance does not guarantee future results. The content of this essay is for informational purposes only. Charts show examples of trends. They do not serve as a recommendation to buy, hold or stay out.