We chase returns. It’s in our blood. We extrapolate the recent past expecting it to continue just like it has. It feels good to imagine our money growing at the rate the stock market or some startup has over the past several years.

“Wow, if we invested $10k in this three years ago, we’d have almost double today.”

Not an uncommon thought process. Also one that often leads to unfulfilled expectations, frustration — and less money in our pocket.

It’s a pattern I’ve worked hard on helping my investors break. I lead with math and logic. Charts and graphs too. Sometimes I dish out a dose of tough love. It’s an art to know who you’re talking to and how to approach the conversation.

The Magellan Fund & ARK Innovation ETF

Strong performance isn’t a cure-all either. People double-up into hot streaks and bail out during crappy periods all the time. Don’t believe me? Remember Peter Lynch’s Magellan Fund which compounded at 29% from 1977-90? Surely his investors crushed it, right? No one would ever sell with that kind of performance, right? Wrong.

The average investor actually lost money. A travesty.

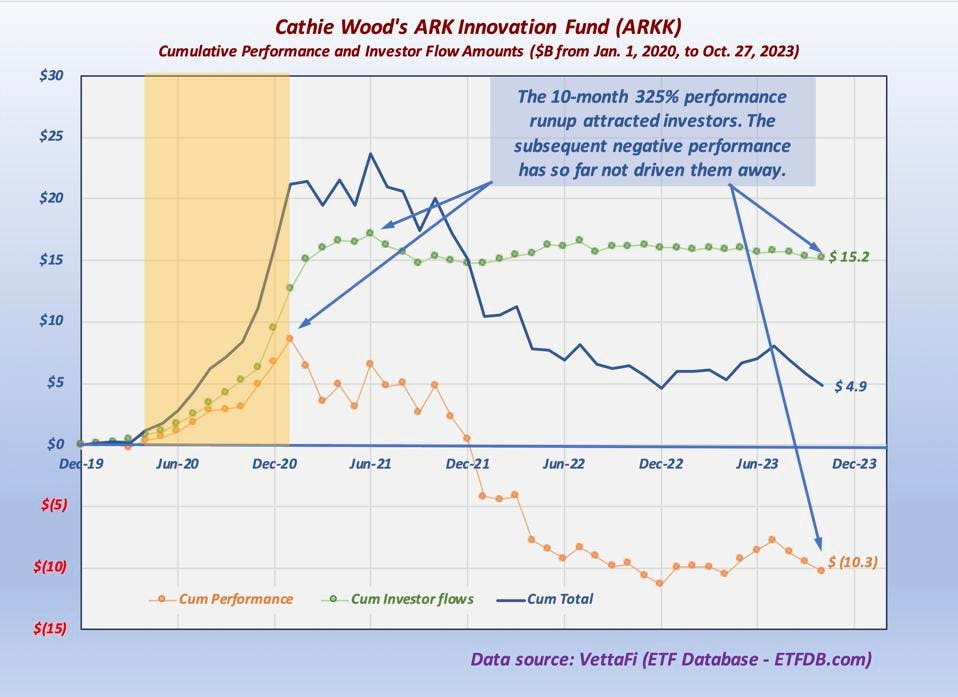

But one that happens all the time. We’ve seen a similar fate befall the investors of Cathie Wood’s ARK Innovation ETF in recent years.

“At the beginning of 2019, ARK Innovation had about $1B. Then, as performance took off, so did inflows, bringing in about $15B in new assets. But then the erosion started. As of October 27, the fund has only $6B in assets left. So, the net loss is about $10B, a huge loss of 63%.” — Forbes article

My Experience

In my early days, when I was making very little money, I was eager for anyone to invest. “Just get in”, I thought. I believed that it was the wise long-term decision, but I didn’t do a good enough job vetting whether their motivations were long-term in nature or if they were just giddy about the recent returns expecting that to be the norm.

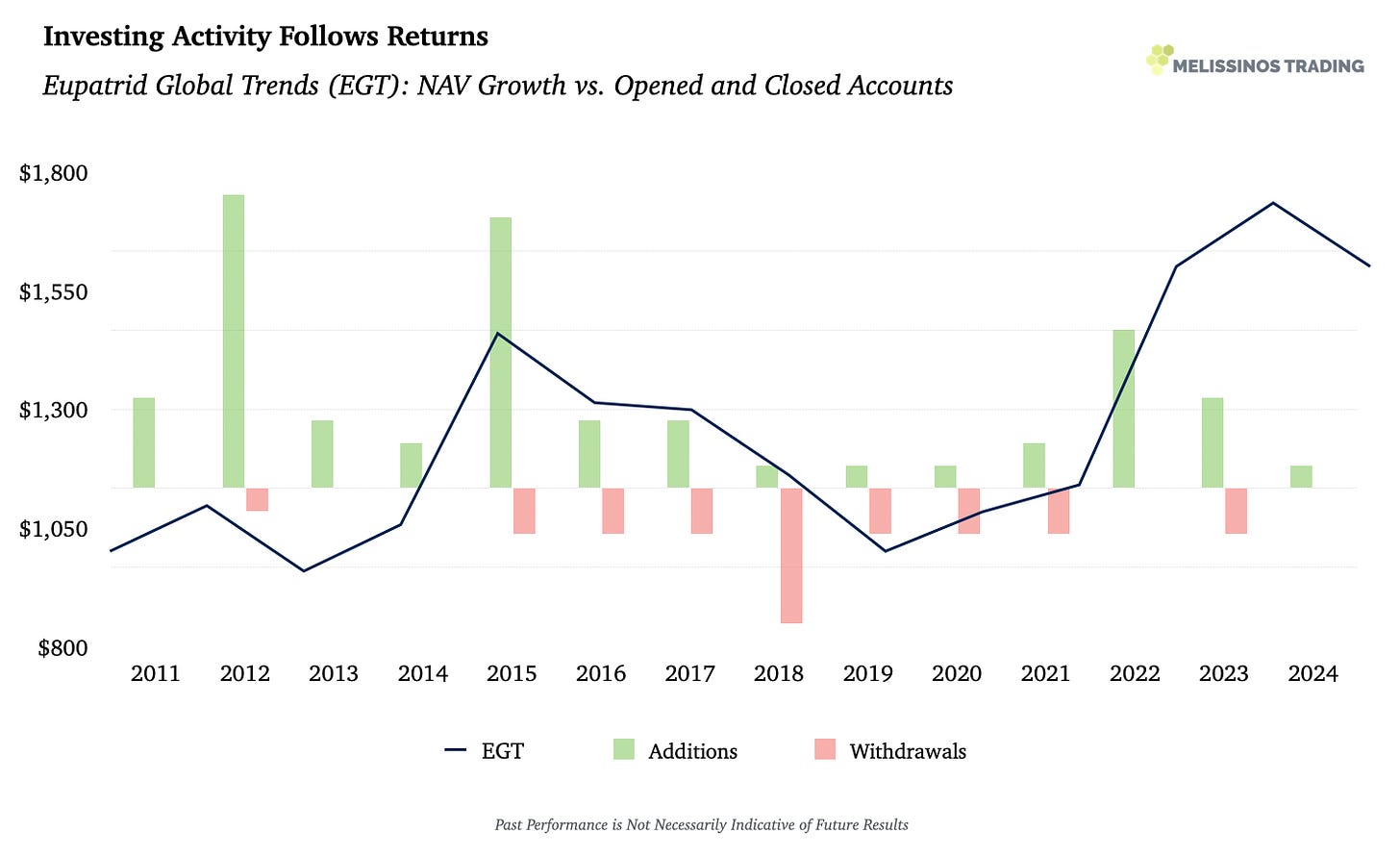

2014 was a great year for Melissinos Trading. No surprise that a lot of new investors signed up the following year. 2016-18 was a tough stretch. And when did a lot of people pull out? You guessed it: 2018 — just as we bottomed and started making money again.

Closing Comments

Performance-related emotions is something we all have to wrangle with.

But we have to recognize the emotions as they come up and listen to what they’re telling us. Maybe our risk tolerance has changed. Maybe we’re too concentrated in one asset class, fund or stock for our liking. Maybe we’re jumping around too much because we’re focused on what everyone else is doing. Maybe our personal expenses are too high which is creating a need for higher returns.

Our emotions aren’t the problem. How we respond to them is what matters.