In 2005, Warren and Pam Adams lost their home during Hurricane Rita. Instead of feeling sorry for themselves, they decided to protect themselves from the next storm.

They moved to Gilchrist, TX and built their new house up to modern codes; designing it to withstand a much stronger storm than the older neighboring homes.

No less than three years later, their house was put to the test when Hurricane Ike hit.

Below is a picture of the Adams’ house in Gilchrist, TX a day or two after Ike. The only one that survived.

Risk is always present, so a little preparation and protection can go a long way.

Market Storms

Today, we’re in between market storms. Many equity indexes are back at highs, so no need to worry right? All is right in the world?

Careful.

The rate of inflation, at least according to the government reports, has decreased over the past couple of years. Yet gas prices are still over $3/gallon in the USA. Cheerios cost almost $7/box. The combination of high home prices and mortgage rates has made monthly payments ridiculous for so many people. Stress in the supply chain is ticking up again too. And the yield curve is still inverted as well.

As a result of all of this, people have racked up $1 trillion in credit card debt.

The pressure on the individual remains high. And now that interest income has become a real investment option again, the perpetual bid underneath financial asset prices may not be there the next time markets get into a jam.

A Buying Opportunity in Trend-Following

Over the past couple of years, trend-following performance has been flat. This happens when there aren’t many large trends to profit from.

For the most part, markets have been calm lately. The consolidations in commodities and currencies, and more recently the sharp reversals in bonds and equities have made it tough for trend-followers to generate strong performance like they did in 2019-21.

But, as we know, markets cycle between calm and volatile periods — and I believe we’re gearing up for some volatile market moves soon.

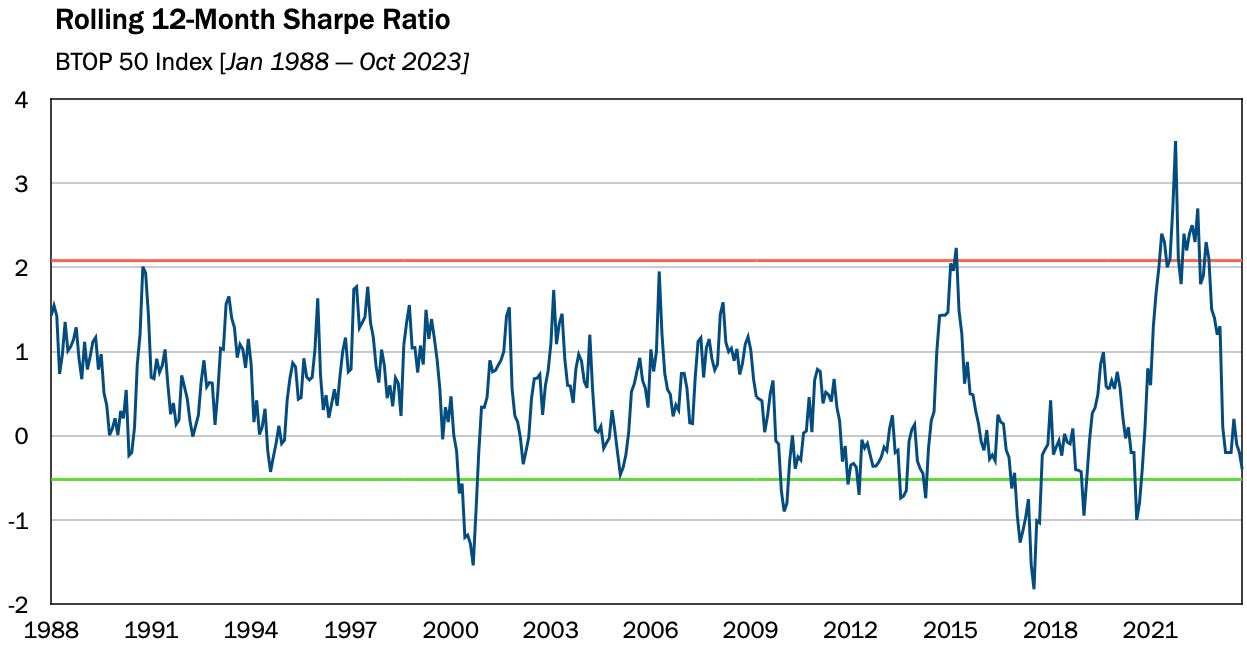

Historically, when recent trend-following performance has been poor while volatility has been high, the next 24-36 months are favorable. Today, we’re in a favorable time to buy in. When the indicator has closed below the 10th percentile (green line), the average next 24-mo return is +10.9%.

I believe there’s a major wave of volatility on the horizon (what exactly will happen I have no idea) and that many investors are vulnerable. They’re not prepared to handle the next storm — and it’s only a matter of time before the next one rolls through.

Disclosure

Past Performance is Not Necessarily Indicative of Future Results. There is always a risk of loss in futures trading.

This communication is for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial product, an official confirmation of any transaction, or as an official statement of Melissinos Trading LLC. All information is subject to change without notice.

The BTOP50 Index seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. The BTOP50 employs a top-down approach in selecting its constituents. The largest investable trading advisor programs, as measured by assets under management, are selected for inclusion in the BTOP50. In each calendar year the selected trading advisors represent, in aggregate, no less than 50% of the investable assets of the Barclay CTA Universe. To be included in the BTOP50, the following criteria must be met:

- Program must be open for investment

- Manager must be willing to provide us daily returns

- Program must have at least two years of trading activity

- Program’s advisor must have at least three years of operating history

- The BTOP50’s portfolio will be equally weighted among the selected programs at the beginning of each calendar year and will be rebalanced annually.

For 2023 there are 21 funds in the Barclay BTOP50 Index.