Most people gather too much sludge in their portfolios. They start out with a few mutual funds and ETFs then, before they know it, a couple dozen stocks make their way in too.

Where did they all come from? Likely from tips here and there, recommendations from articles they read or a shows they watched.

The problem is not so much that they arrived, but that they never left. Taking the chance (provided it’s a calculated one) is healthy, but with sticking with the losers for too long is how you lose a lot of money and fall way behind. Do this enough and you eventually impact your standard of living in a meaningful way. You have to work several extra years, downsize your home, have to pass on vacation this year, etc.

How many times have you heard about ideas or trades becoming “long-term investments”? I hear it all the time. It’s all too common problem that wreaks havoc on our wealth.

Believing we are special and can pick the right ones gets us into a lot of trouble. We can’t pick winners with any regularity. No one can. We’d be lucky if half the trades we made turned out to make money. This is why adopting a trend-following approach is so important.

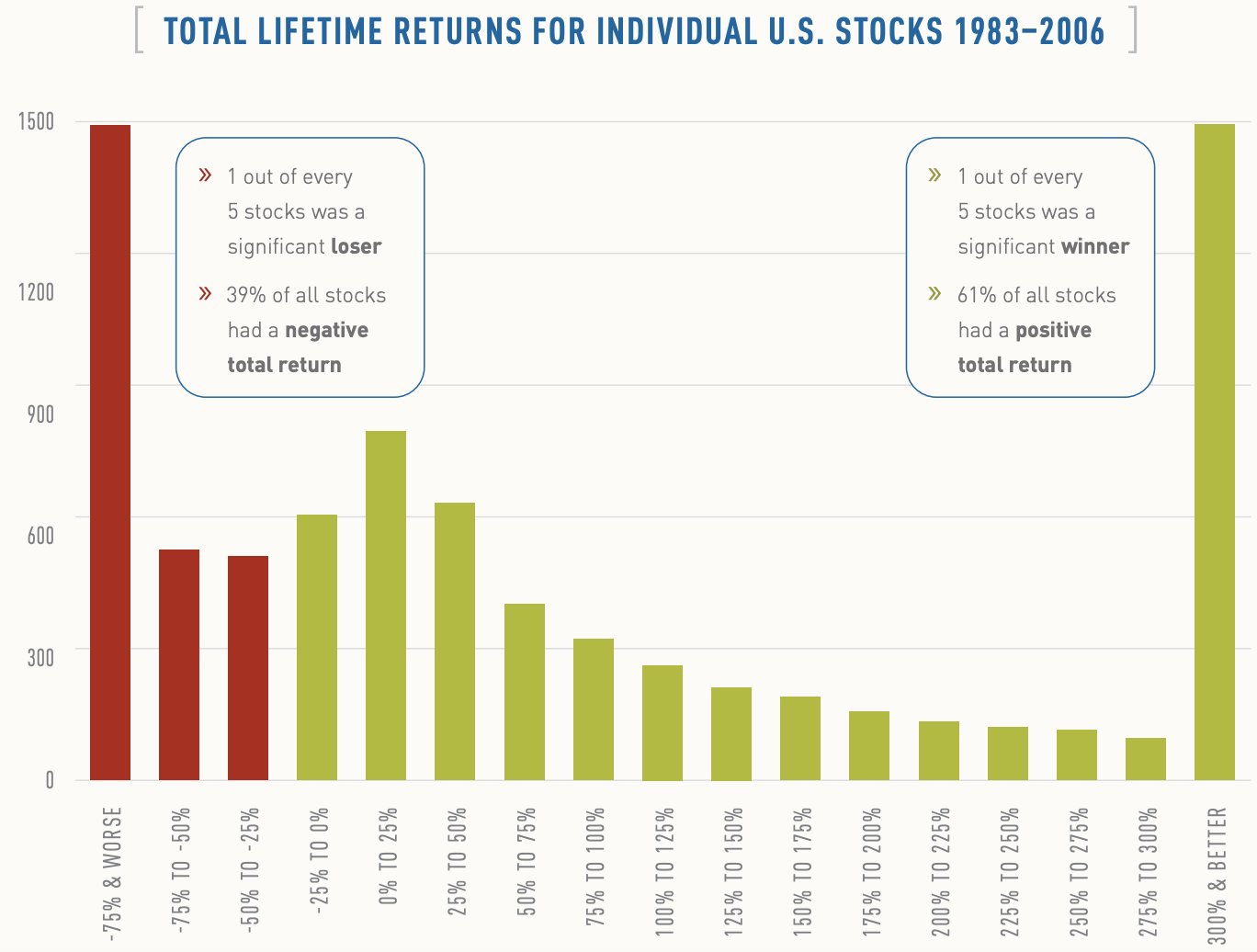

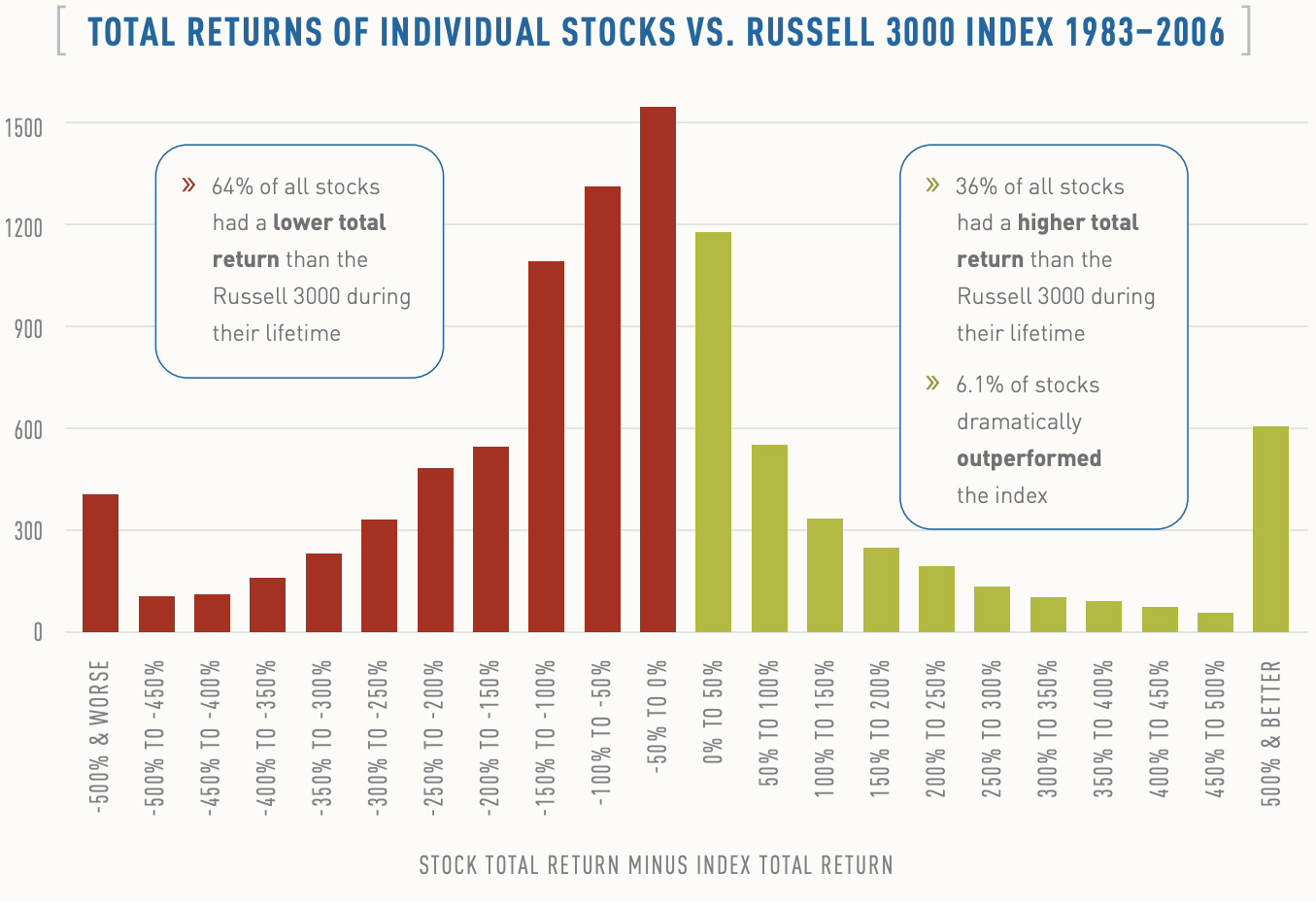

Most stocks over the long run don’t produce any meaningful return at all. Only a small percentage of stocks account for all index gains.

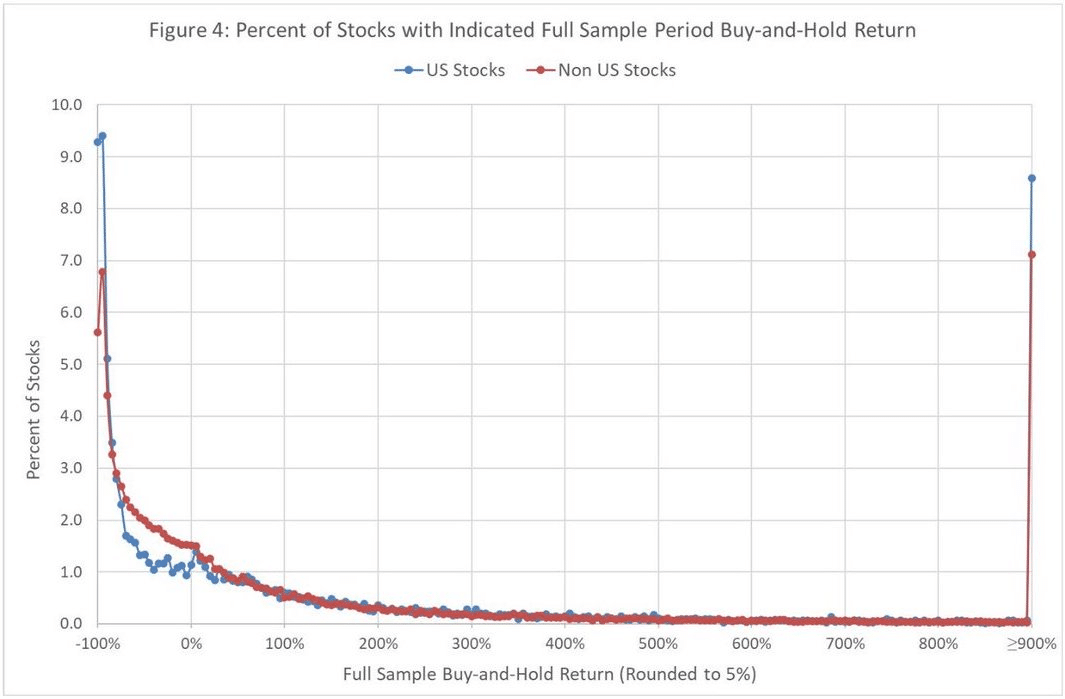

“In a study across 64,000 stocks from January 1990 to December 2020, the majority, 55.2% of U.S. stocks and 57.4% of non-U.S. stocks, underperform one-month U.S. T-bills in terms of compound returns. Also, the top-performing 2.4% of firms account for all of the $US 75.7 trillion in net global stock market wealth creation from 1990 to December 2020.” — link to research

Longboard Asset Management found similar results in their research from 2008.

What more evidence do you need to understand that 1) nearly all of the picks you make will not be the best performers, but likely a net-loser and 2) even if you did pick one of the 2% unicorns, you’d have to position size correctly, hold on through large drawdowns and not take profits too soon to make any meaningful money.

I have always hated clutter. If I don’t need it, I throw it out. Maybe it’s my private school upbringing wearing uniforms for 20 years. Sports too. I couldn’t perform well if I looked sloppy. Nothing could be out of place or in my way. My portfolio cannot perform well with excess fat in it. If it’s not producing, out it goes.

It’s important not to fall in love in this business. It’s a trade, not your spouse or child. Get rid of it to make room for new opportunities. Don’t let small losers become big ones. Keep the portfolio fresh by going with trends, holding winners and ditching losers.