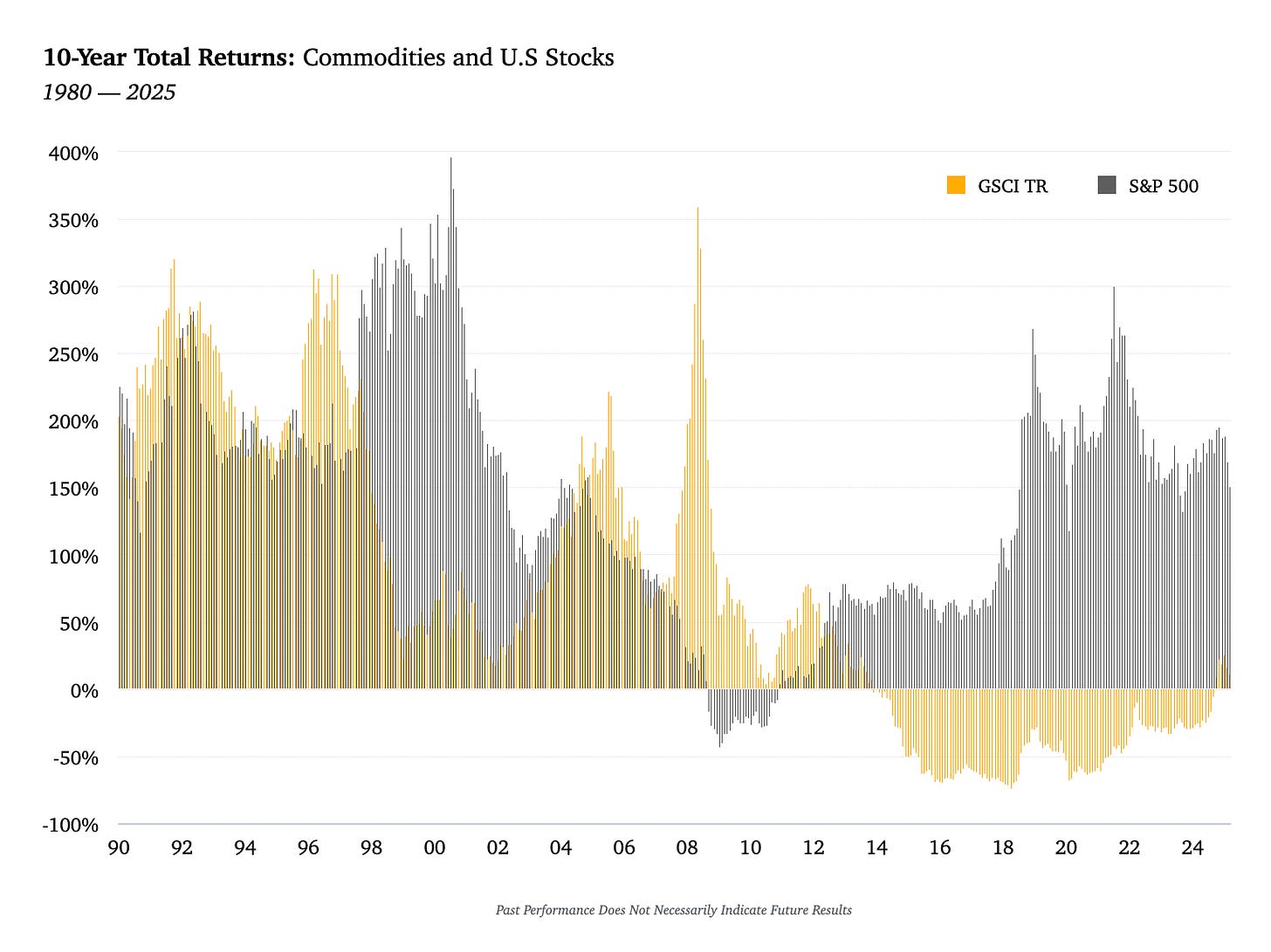

The chart says it all. Outside of the Q4-20 to Q3-22 blip, equities have left commodities in the dust over the past 15 years. Not exactly the ideal environment for commodities-heavy trend-following traders like me, but I’m not here to whine and complain. I did enough of that over the past few weeks.

All I want to do is point out that the trend is turning up again. Does this mean we’ll get some juicy commodity uptrends? Maybe. Hopefully. Maybe the trend will whipsaw though and go back down. Or maybe equities and commodities will both decline, but the latter just less so. No one knows, but the trend is changing.

It wasn’t that long ago when commodities outperformed equities over a 10-year period. Not many know that or can even fathom it, but it happened. It can happen again too.

“Yea yea yea. I’ve been hearing about commodities for a long time now. They never go up.”

“Don’t waste your time with commodities. Stick with stocks.”

“Commodities? What are you a gold bug? This isn’t the 70’s.”

New trends tend to be greeted with doubt, especially when the recent past reinforces the opposite. We’ll see how this one develops.

Disclaimer: Past performance does not guarantee future results. The content of this essay is for informational purposes only. Charts show examples of trends. They do not serve as a recommendation to buy, hold or stay out.