Reliable is Cool

We all love more features, more customization, more of the bells and whistles. We get bored with tried-and-true. We crave the new-and-improved even if it means taking on more risk. Opening the present becomes more important than the present itself. The journey away from battle-tested and reliable methods often leads to failure. The basics are […]

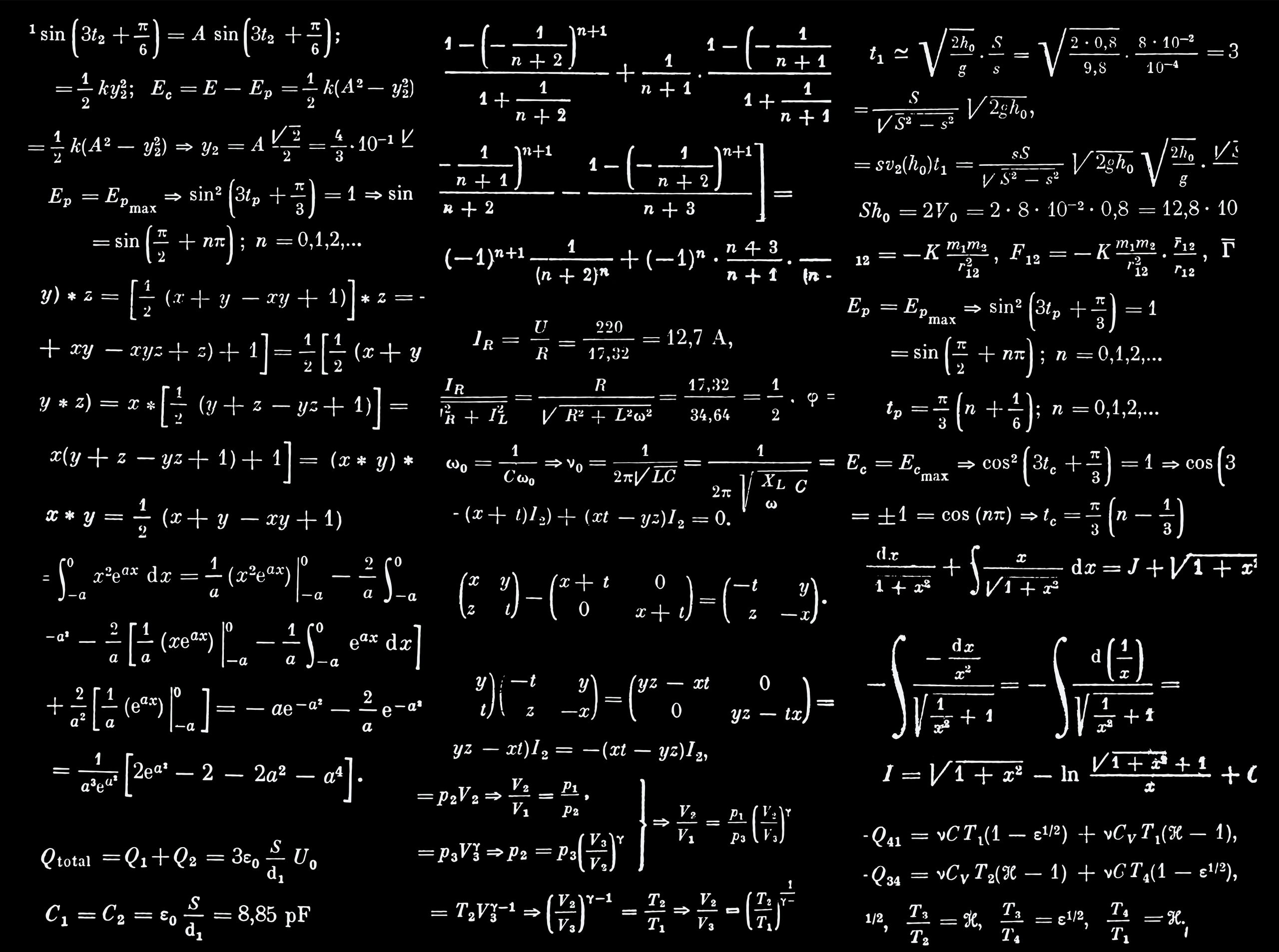

Too Many Metrics

I don’t have performance-standards for my trading. No goals for annualized growth figures or anything like that. That’s a recipe for stress and failure. I simply start with “how much am I willing to lose?”. All I can control is how much I risk on each trade. Based on historical research and trading in real […]

Excess Gets Washed Away

Forest fires clear the way for new growth. Storms remove stale air out of a region. Predators cull the weak, which helps control overpopulation. Bear markets purge greedy speculators and those that gather an abundance of debt. Nature has its way of regulating itself. Same goes for the markets. Greedy speculators become blinded to risk. […]

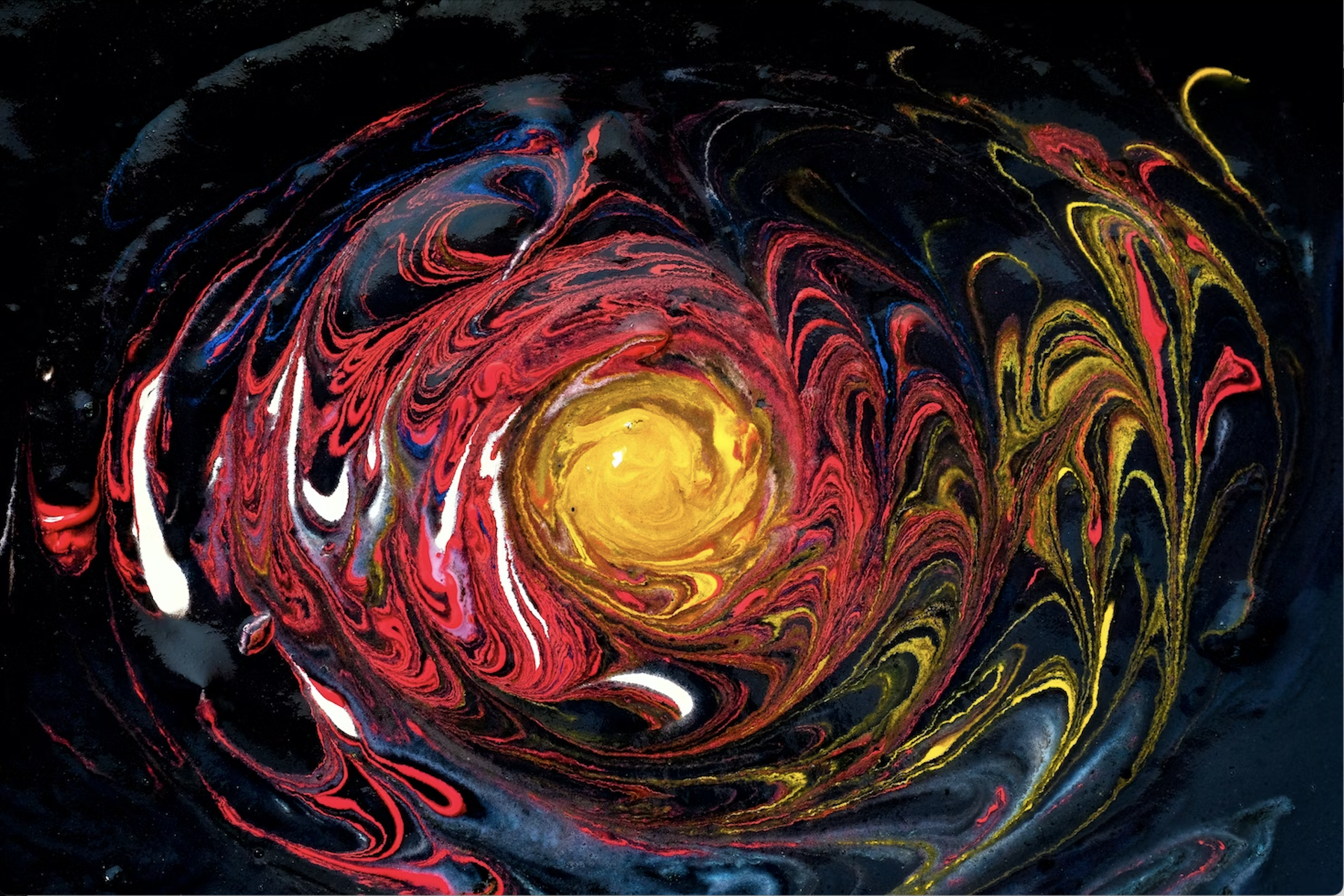

Medicating the Chaos

Deep down, we all know cycles are natural and something to expect when playing the markets. Stocks, bonds, commodities, currencies, investment strategies — hell, everything in the cosmos — experiences cycles. Some cycles flow calmly and predictably. Others not so much. More often than not, we get chaos. Investors love consistency — even at the […]

Research is Overrated

This weekend I was speaking with a young trader and a question about research inevitably came up. “What research are you working on to maintain your edge in the markets?” My answer: Following your system is exponentially more important than researching new trading tactics. Progress from research typically occurs by accident often following dramatic emotional […]

Distaste for Waste

Most people gather too much sludge in their portfolios. They start out with a few mutual funds and ETFs then, before they know it, a couple dozen stocks make their way in too. Where did they all come from? Likely from tips here and there, recommendations from articles they read or a shows they watched. […]

Ditch the Script

The answer to what the markets will do cannot be found in multiple choice answers A through D. The question to ask is not “what will the markets do over the next 12-24 months?”, but “what can the markets do over the next 12-24 months?” The answer: (E) anything That’s always the answer. Most people […]

Where Are Markets Headed?

Where we are might serve as a pretty good indicator of where we’re going. The trick is to actually observe what’s happening, not what’s being said. Fundamentally speaking, which I’m not very good at in the slightest but I’ll take a shot at summarizing the current environment — we have inflation figures declining around the […]

My Forever Home

Nothing is forever. We all know it. Healthy and successful people prepare accordingly while others hope and wish for ideal. Trading preparation for hope is a losing formula. Seeking pleasure over preparation softens our muscles. It exposes us to danger. We don’t realize it because we’re feeling so good in our hope-driven play world to […]

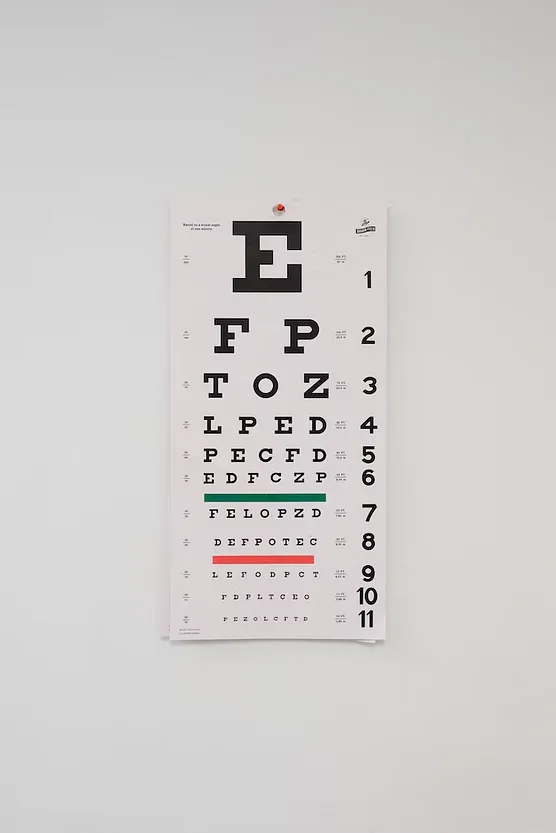

Seeing is Believing

Changing someones mind with words doesn’t work. They need to see action. They need real life results. Nature requires us to adapt, but it’s funny to me that we build impenetrable walls in our minds that prohibit us from changing our minds. How the hell did that happen? That seems like an evolutionary glitch, but […]