Trend-Following in 2008: From +70% to Negative 1% to +92%

One thing you must know about trend-following is that even during great periods, the financial and emotional swings can be significant. Take 2008 as an example. Trend-following performed very well overall when many asset classes got crushed. While you may remember the annual result being stellar, you may not remember the frequent and steep drawdowns […]

Wait? Yes. Hesitate? No.

Over the past few weeks, trend-followers have likely been whipsawed out of many positions and initiated new ones. It’s times like these during intense volatility when the urge to indulge your feelings creeps in. “Let’s scale back.” “Things are crazy right now. Can we even trust this new entry signal?” “This move only happened because […]

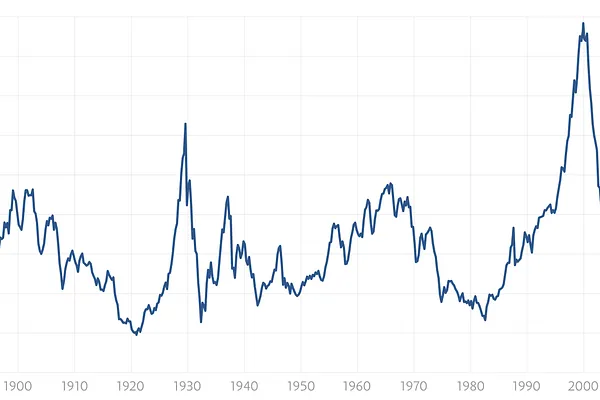

Commodities are Breaking Out vs Stocks

The chart says it all. Outside of the Q4-20 to Q3-22 blip, equities have left commodities in the dust over the past 15 years. Not exactly the ideal environment for commodities-heavy trend-following traders like me, but I’m not here to whine and complain. I did enough of that over the past few weeks. All I […]

What’s New? How About What’s Old?

The pursuit for the new edge remains constant. The new indicator that predicts recessions or when bull markets will begin and end. The new processes that get rid of those pesky drawdowns or, hell, volatility altogether. New new new is better than old old old — at least that’s what many of us want to […]

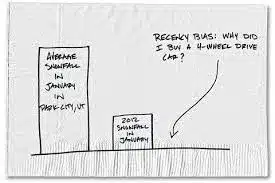

Your Beliefs About Investing Likely Depends When You Start

We must not discount the effects recent performance has on our beliefs and behavior. What we know to be true may only have been true…lately. It’s a big world out there with a lot of history. There’s no telling what the future can bring, so holding on to beliefs makes you less adaptive and more […]

I’m Worried About Stocks

The speculative culture we’re currently living in has me a little worried for a lot of investors. The Schiller P/E ratio and Buffett Indicator are at/near all-time highs. Stock market optimism is through the roof. Berkshire’s cash balance as a percentage of total assets has hit new highs. The yield curve just un-inverted after two years. Inflation is ticking back up. […]

Anything for a Dollar

Have you seen the nonsense out there lately? Hawk Tua coin? Luigi Mangione coin? What else am I missing? Oh, right…FARTCOIN! Throw in the Tyson-Paul “fight” too. Another marketing flim-flam masquerading as a boxing match. Hawk Tuah Coin Luigi Mangione Coin Fartcoin Fartcoin has a market cap of $550 million. Five hundred fifty […]

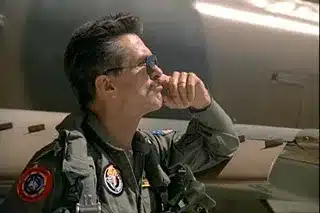

“Fly Jets Long Enough, Something Like this Happens”

One of my favorite lines from one of my favorite movies. For some reason this line from Top Gun, delivered by Tom Skerritt to Tom Cruise following Goose’s death, has always stuck with me. Maybe it was the way he said it. The tone. The matter-of-fact nature. The stoic undertone in such an emotional scene. […]

Industry Speak

Our industry is allergic to plain speaking. It’s addicted to bullshit buzzwords and terminology. The secret sauce (there is none) must be guarded, so the effort is directed towards jargon for the purpose of making people think you’re in-the-know. Confuse them so much that they have trouble asking questions. People want to believe there’s someone […]

Lost Decades Happen to All Investments

They’re not mythical. They happen. And no I am not suggesting a lost decade is coming soon to equities or any other major asset-class, but I want take a step back and provide some perspective because I think we’ve collectively forgotten that negative returns can and will happen. Gold, for example, spent a few decades […]