Trend-Following Balances Optimism and Pessimism

Absent a systematic and responsible plan, our emotions will run things. When shit hits the fan, we’ll be too scared to get in. When we hear some suited up analyst on television talking positively about the stock we own, we’ll be too hopeful to get out when the trend turns. Systematic trend-following can help us […]

What Are You Talking About?

Fundamental traders have been getting their teeth kicked in this year. Perusing through some Q3 letters recently, I see plenty of jargon explaining why performance has been so bad. “We are finding that our core holdings are experiencing greater than expected market headwinds in the face of a more challenging operating environment, inflation-driven costs pressures […]

Why Should I Invest With You vs. Them?

Sometimes, I get asked this question. My honest response: “I don’t know. Try us both out and see who prefer. If you don’t choose me, please let me know why. I’d love to know.” I believe choosing an investment manager is an intimate and personal choice. Surely I can point investors to my performance page […]

Crazy, Stupid, Trends

As I’ve said many times, I am an anti-fundamentalist. I do not comb through a company’s financials or industry reports to calculate the “right” price for a particular stock or market. I do not buy when I perceive the market value to be below what I think it should be. I believe all information gets […]

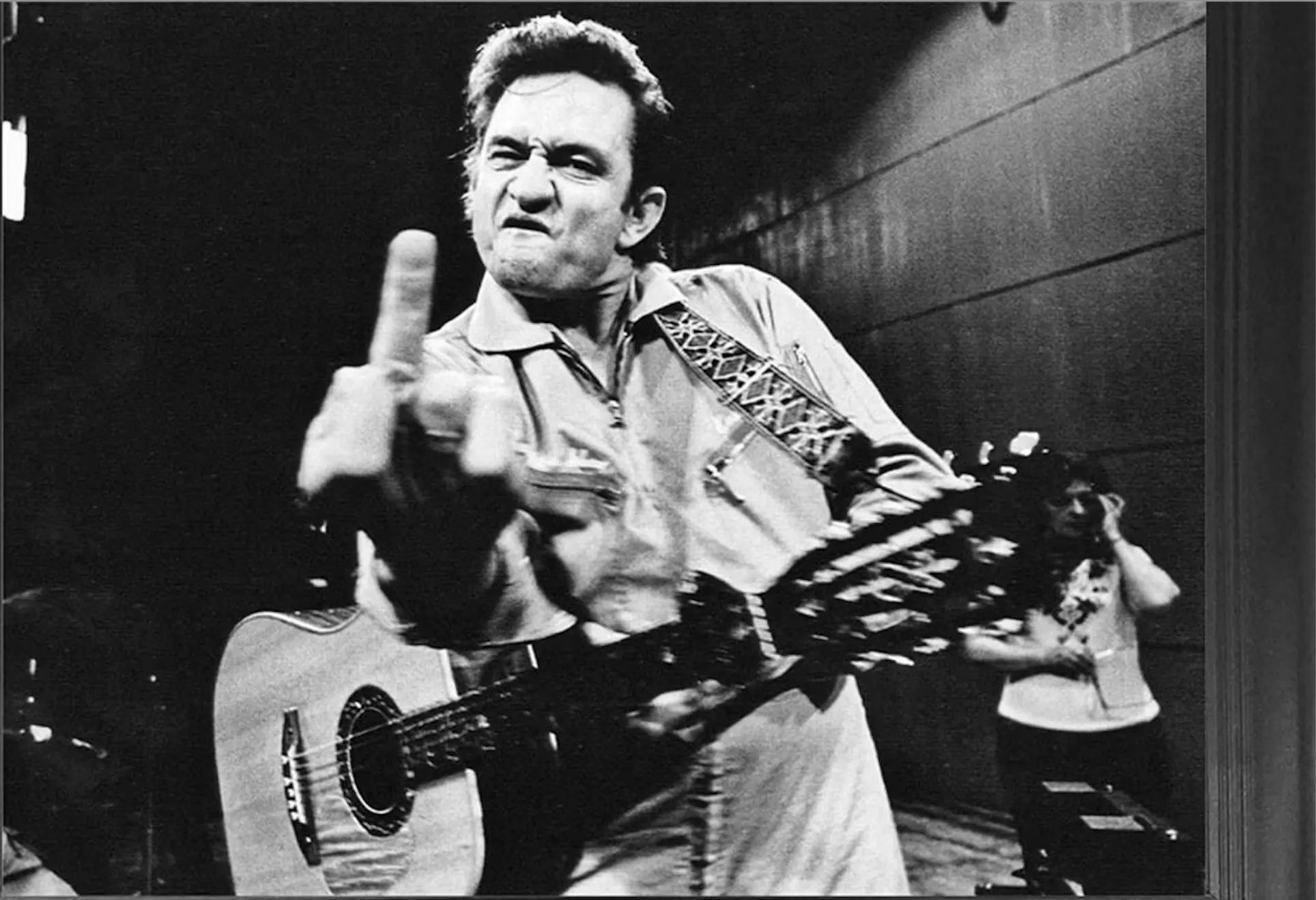

Avoiding Nice

I have nothing in common with a person who thinks it’s a good idea to hold on to META, for example, through a -70% decline because “it’s still a good company” or “I believe in Zuck!”. I’m OK with giving back some profits and sitting through a little bit of pain, but -70%? No. That’s […]

Motivation by Frustration

Working at my first job after college in 2007, I recall getting the idea to start a fund. It was mostly a “that would be cool” kind of idea. Very wishy washy and dreamy. My motivations turned serious though when the Financial Crisis unfolded. I lost money and my job at JP Morgan. I felt […]

Harvest Season

Fall is here. Crops are ready to be harvested. All of the hard work farmers have done since the spring is about to pay off. Pumpkins, turnips, squash, zucchini, beets, eggplant, celery, apples, cranberries, grapes, pears, and pomegranates. There are more, but these are the main ones. Market cycles aren’t regular like crops are, but […]

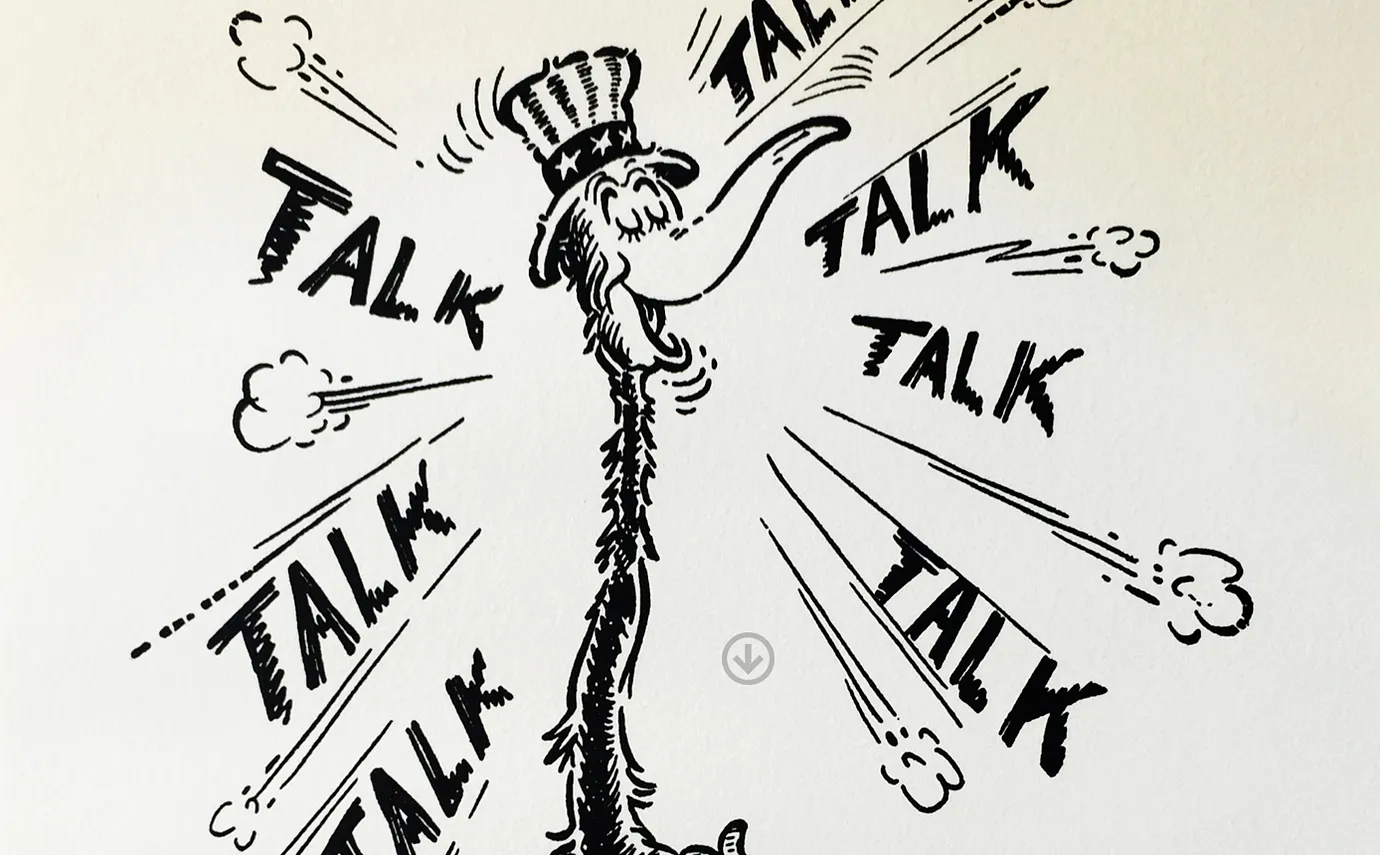

Words Cannot Save You

When people get nervous they embrace many unhealthy remedies. They do all they can to avoid feeling nervous. In the markets, a popular remedy is talking. People like to talk and talk and talk. And talk and talk and talk. When positions are going against them, people construct a story of why they bought XYZ […]

Pareidolia

Bulls and Bears suffer from the same affliction — pareidolia. That is, seeing something, typically a pattern or image, that isn’t there. Examples of pareidolia: Bulls see the current equities chart pattern as one that looks like a previous uptrend. From this, they forecast higher prices. Bears, as you can imagine, see the opposite. People […]

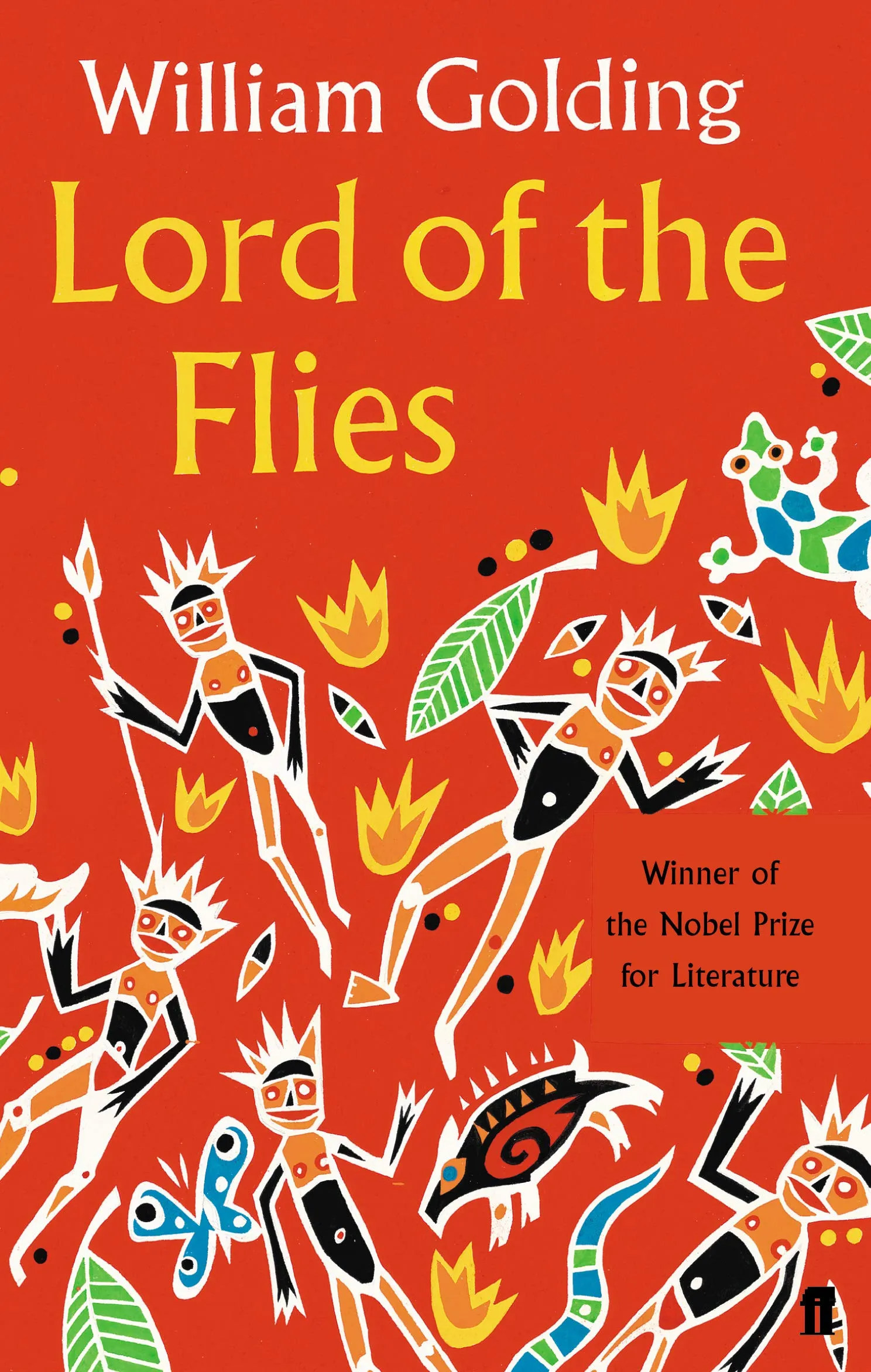

"Like Kids"

I had never read Lord of the Flies, but recently I’ve been intrigued by the old classics, so I picked it up. Early in the book, as the boys collect their bearings, they agree to make a signal fire to call for help. Thrilled by the prospect of no adults, and consequences as a result, […]