“If you think you are too small to be effective, you have never been in bed with a mosquito.” — Betty Reese

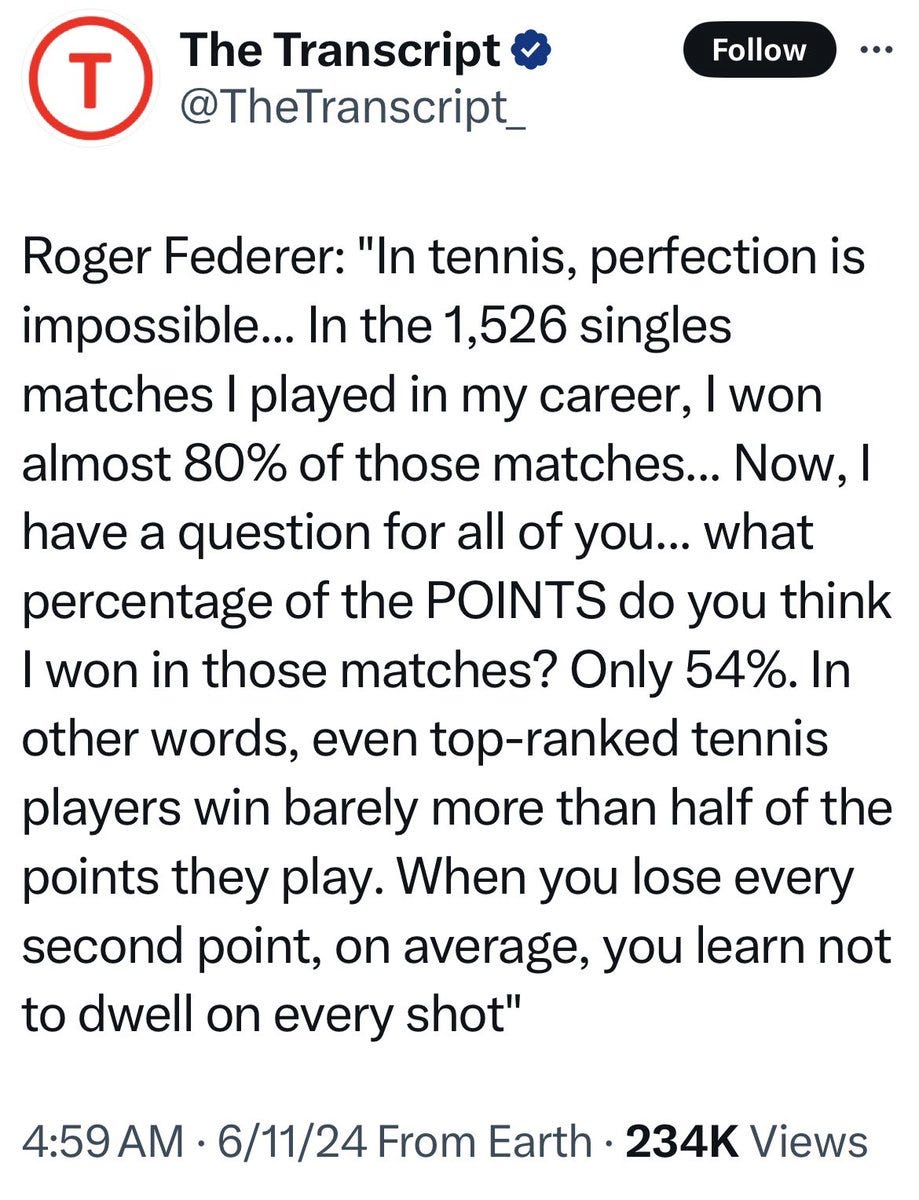

- Competitive advantages, especially obvious ones, don’t last long. Roger Federer became the best tennis player of his time with only a slight advantage in points won.

- Competition and evolution never stops. One simple unsexy way to improve your business (or personal finance) survival odds? Spend less than you make.

- Big companies, like big animals, need more resources to accommodate themselves. Take a look at how many companies have gone out of business after once being a component of the Dow Jones Industrial Average.

- Darlings of yesterday can, and often do, become the toads of tomorrow. Asset-class and investing strategy performance are no exception; routinely cycling through periods of above/below-average returns.

A slight edge, with impeccable discipline and some luck, goes a long way to surviving in the financial markets with reasonable success (with regular bumps in the road of course).

Extravagant profits typically attract other opportunists to that particular stock or investment strategy. In turn, this reduces (even eliminates) the edge. It’s important to remember that the flip side of extreme profits is its exact opposite. Think COVID/Work-from-Home stocks such as Wayfair, Teladoc, Docusign and Zoom. Think of Cathy Wood’s ARKK fund.

Performance cycles like everything else in life.

The edge that these stocks benefited from was short-lived. Maybe they right the ship. Maybe they don’t. But the point is that there have been countless stocks before them that achieved similar short-term success, because of an extreme edge (or luck), that have disappeared into oblivion.

The most recent decade, stocks (tech, especially) have outperformed. Was this the case the decade before? No. Will it be the next decade? Maybe. Maybe not. No one knows. But betting the farm without the open mind to adapt is one of the reasons how investors underperform, even go bust.

Similarly to Federer, trend-following trading systems also possess a slight edge. Typically earning a profit on half of the trades, but making twice the profit on the winners. A 50-50 split with a 2:1 average profit-to-loss ratio is enough to not draw a lot of attention to itself — thereby, I think, increasing the odds of it’s sustainability over the long run.

More on Small

Only smaller animals could have a chance in a manmade world [Sustainability-Times].

What are the evolutionary advantages to size? [WorldBuilding]

Small is the new big [Seth Godin]

Grow Slow, Stay Small [Jason Fried]