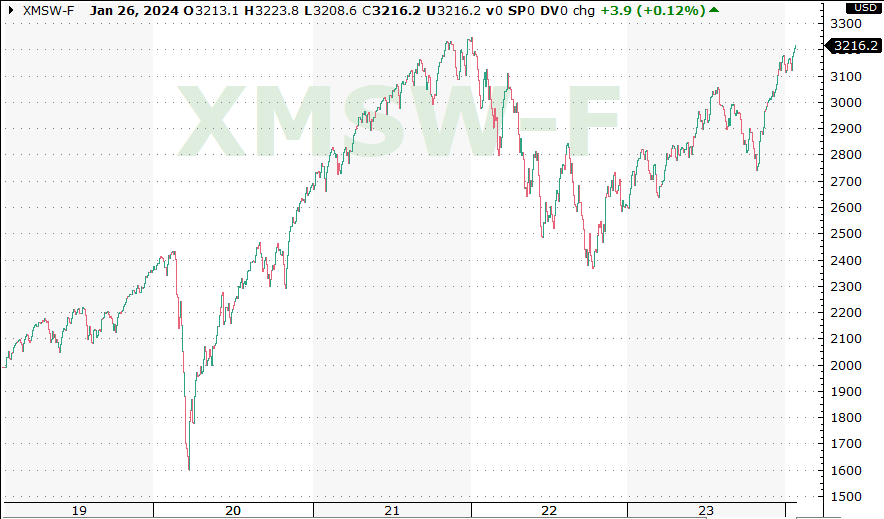

It’s January 2013 and the general feeling about the stock market is much less cocky than it is today. We’re 4-5 years removed from the Financial Crisis when stocks lost half of their value. Fear and cautiousness are still in the air — and this is after a ~90% rally off the March 2009 lows (using the MSCI World Index).

On the five-year charts, the crash of 2008 is still in view. We’re reminded of it every time we look at them. The pain, despair and fear we felt are still present. Memories too. People are waiting for stocks to roll over again and go back to the 2009 lows.

People wonder if we’re out of the woods of the Crisis yet. As with every extreme bear market, a new crop of skeptics is born. They don’t trust anymore. Not Wall Street. Not stocks. Not the trend. Narrative and emotions matter more than the trend. Investors see the uptrend and question it. They imagine the impending reversal.

The average investor is waiting for more confirmation — which is bullshit for, “I’m still scared and unprepared and I have no idea what will make me get back in.” I know what will — greed, frustration and jealousy and these haven’t overtaken the feelings of fear just yet.

At this time, most investors feel they cannot afford to take another loss, so they cannot get back in. A common, but costly mistake people make over time.

Compare this to today. Sure, people still experience the typical range of emotions they always have but there’s more of a confident foundation in stocks now than there was then. Recent performance changed that.

When you pull up a chart, you see a big uptrend with small stumbles along the way. You forget about what has happened. You forget about what can happen. All you do is extrapolate the recent past believing this is how it is now — stocks just go up and that’s that.

Short memories indeed. It’s funny how recent performance can change someone’s feelings and confidence about the future.

In 2013, the upside opportunity was probably bigger than it is today (who really knows though), but people feel more confident today because of strong recent performance. Outside of 2022 and quick Covid crash, it’s been a steady ride up for stocks.

I caution you to not get too carried away. To not let a recent run of good fortune make you throw caution into the wind and overextend. Risk is always present. Losses can come fast and furiously. Skipping la-dee-da through the markets without a worry in the world is what many people were doing in 2007.

A little cautiousness and preparedness would’ve been a good idea then. It’s a good idea now. It’s a good idea always.