The past couple of months have been tough on trend-followers, myself included. The sharp reversals in interest rates, equities and currencies accounted for most of the losses.

While the very recent performance has been painful, these “losses” from a trading perspective have simply been giving back some of the profits made over the past few years. No one likes giving back profits, but it’s often the price to pay for capturing a large chunk of the trend.

It’s also important to realize that despite a tough November and December, trend-following performance over the past few years has been strong. But these tough short-term periods, and I want to stress short-term here, often present great investing opportunities.

Sometimes confidence gets shaken when losses occur. That’s understandable. But it’s important to maintain a cool head and not make any rash decisions.

It’s important to realize that these tough short-term periods are expected — and are by design!

Because we don’t curve fit our approach to fit any specific situation, we can experience volatile swings like this. Trying to eliminate all negative volatility, an all-too-popular effort, typically leads to catastrophic losses at some point and many missed opportunities along the way.

That’s not a tradeoff I’m comfortable with.

A Buying Opportunity in Trend-Following

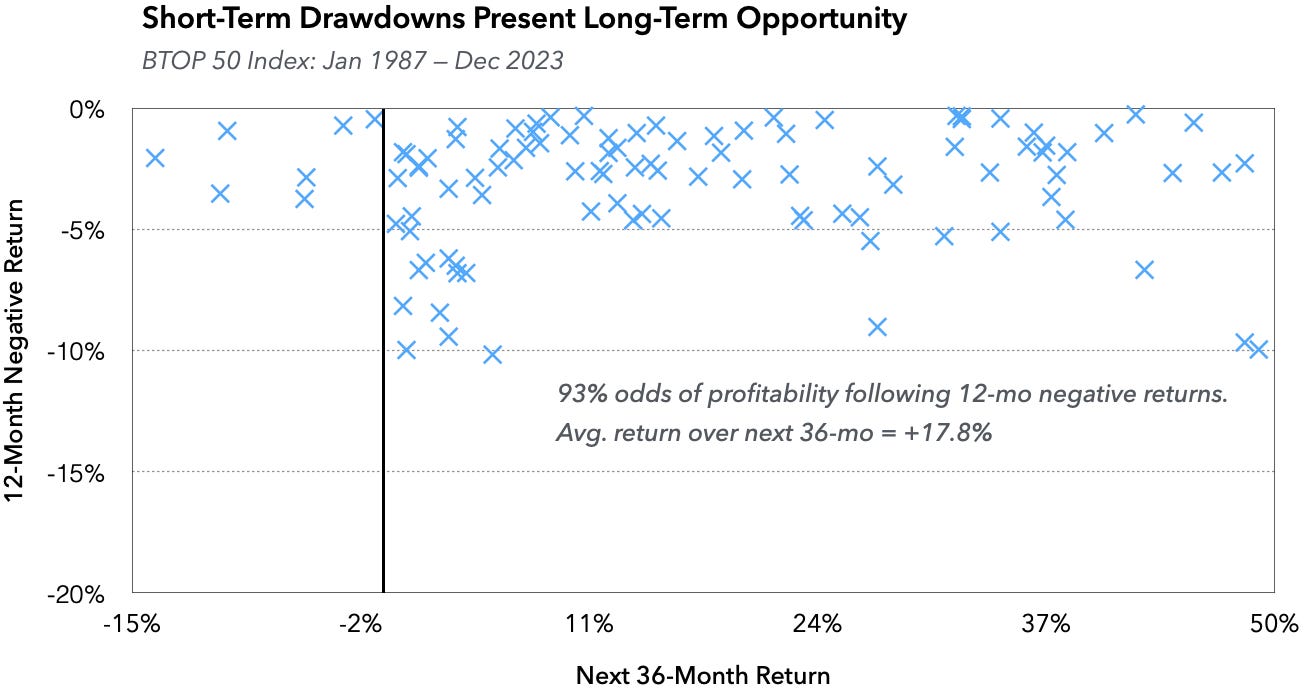

The BTOP 50, a popular index comprised mostly of trend-followers, currently sits in a -6.3% drawdown (as of Dec-23) and has returned -1.9% over the past 12 months. Since its 1987 inception, there have been 106 instances where the 12-mo return was negative (and that have at least 36-mo of performance after each instance).

The average return following a 12-mo negative return over the subsequent 36-months has been +17.8% with the return being profitable ~93% of the time (99/106).

Pretty good I’d say.

Of course, we don’t know what will happen over the next 24 months, but the odds favor a strong upcoming period for trend-following.

These are precisely the moments when we make mistakes — when recent performance stinks and our impatience and frustration get the best of us. It’s so so so important to stay level-headed and continue to do the right things.

Disclosure

Past Performance is Not Necessarily Indicative of Future Results. There is always a risk of loss in futures trading.

This communication is for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial product, an official confirmation of any transaction, or as an official statement of Melissinos Trading LLC. All information is subject to change without notice.

The BTOP50 Index seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. The BTOP50 employs a top-down approach in selecting its constituents. The largest investable trading advisor programs, as measured by assets under management, are selected for inclusion in the BTOP50. In each calendar year the selected trading advisors represent, in aggregate, no less than 50% of the investable assets of the Barclay CTA Universe. To be included in the BTOP50, the following criteria must be met:

- Program must be open for investment

- Manager must be willing to provide us daily returns

- Program must have at least two years of trading activity

- Program’s advisor must have at least three years of operating history

- The BTOP50’s portfolio will be equally weighted among the selected programs at the beginning of each calendar year and will be rebalanced annually.

For 2023 there are 21 funds in the Barclay BTOP50 Index.